Mom

There are many different kinds of Moms, all equally as special. Maybe you have fostered or adopted a child, maybe your pets are your children, maybe your a Step-Mom aka bonus Mom, maybe you have just been there for someone and loved them unconditionally.

There are many different kinds of Moms, all equally as special. Maybe you have fostered or adopted a child, maybe your pets are your children, maybe your a Step-Mom aka bonus Mom, maybe you have just been there for someone and loved them unconditionally. Either way that makes you a Mom in my books.

Mom’s do a lot for their families whether they are blood related or not. Mothers work hard taking care of their loved one(s). If you have lost your mom, I am sorry. Please know she is with you, in your heart and memories forever.

A Mother’s love is unconditional even when you aren’t with them. Even when they are mad at you they still love you. That is something you shouldn’t forget. Never take your mother for granted, because one day she’s gonna be gone and you don’t ever know when. It could be tomorrow, in a couple of days, in a couple of weeks, years, it could even be today. The point is your mother loves you and you should so your love and appreciation for her. It will only takes a couple of minutes to stop what your doing and go tell your mom that you love her. Text her, or call her and tell her.

If you need a reminder of all mom’s do, check out this video also shown below.

Mom:

Here’s a funny reminder of all that moms do:

World's Toughest Job NOTE: MUST WATCH UNTIL THE END

Job Posting: Director of Operations Job Requirements: Excellent Negotiation Interpersonal skills Degree in Medicine, Finance and Culinary Arts Mobility. You must be able to work standing-up most or really all of the time 24 Hours a Day, 7 days a Week, 365 Days

SALARY: NOTHING

Make sure you Thank your Mom and tell her you love her.

Michelle

2019 Federal Budget

2019 Federal BUDGET SUMMARY

Effective for 2019 and subsequent taxation years, the budget proposes to introduce….

BUDGET SUMMARY

Measures for Individuals

Canada Training Credit

Effective for 2019 and subsequent taxation years, the budget proposes to introduce the Canada Training Credit, a refundable tax credit to assist working Canadians with the cost of professional development. The credit is the lesser of eligible tuition and a new notional account. Eligible individuals will accumulate $250 each taxation year in a notional account.

To be eligible individuals must:

• file a tax return for the year;

• be at least 25 years old and less than 65 years old at the end of the year;

• be resident in Canada throughout the taxation year;

• have net income under the third federal bracket $147,667 (for 2019)

The lifetime maximum is $5,000, which expires the year an individual turns 65 years of age.

The federal tuition 15 per cent non-refundable tax credit will still be available on the difference between the eligible tuition fees and the refundable Canada Training Credit.

Home Buyers Plan

Effective March 21, 2019, the 2019 budget proposes to increase the withdrawal for first time home buyers under the Home buyers Plan from $25,000 to $35,000 ($70,000 spouse/common-law partner) from their registered retirement savings plan (RRSP) to purchase or build a home, without being taxed on the withdrawal. The withdrawal must be repaid over 15 years, starting the second year following the year in which the withdrawal was made.

Also, individuals experiencing a marriage breakdown generally would not qualify as first-time home buyers under the Home buyers plan. However, the proposals will allow these individuals to now qualify as first-time homeowners to access $35,000 from their RRSP to purchase a home.

Change in Use of Multi-Unit Residential Properties

When a taxpayer’s property changes use from an income producing to principal residence or vice versa the Income Tax Act (ITA)deems the taxpayer to have disposed of, and reacquired, the property at fair market value. An election is available to defer the deemed disposition until the property is sold, offering a tax deferral if an income producing property had an inherent gain or, as in the case of a principal residence, 4 additional years can be designated for tax exemption, provided certain criteria are met.

Under the current rules these elections are only available for complete changes in use and not partial changes of use. Generally, multi-unit residential properties such as a duplex could not benefit from use of these elections.

Effective March 21, 2019, the budget proposes to extend the elections to partial changes of use that are currently available for complete changes of use.

Additional Options in Creating Retirement Income from Registered Plans

To provide Canadians with greater flexibility in managing their retirement savings, Budget 2019 proposes to permit two new types of annuities for certain registered plans:

Advanced life deferred annuities (ALDA) will be permitted under a registered retirement savings plan (RRSP), registered retirement income fund (RRIF), deferred profit-sharing plan (DPSP), pooled registered pension plan (PRPP) and defined contribution registered pension plan (RPP); and

variable payment life annuities will be permitted under a PRPP and defined contribution RPP.

The measures will apply to the 2020 and subsequent taxation years.

a) Advanced Life Deferred Annuities (ALDA)

When an individual chooses to purchase an annuity with registered funds, the tax rules require commencement of the annuity by the end of the year in which the annuitant reaches age 71. Budget 2019 proposes to amend the tax rules to permit an ALDA to be a qualifying annuity purchase, or a qualified investment for certain registered plans. An ALDA is a life annuity that can be deferred until the end of the year in which the annuitant attains 85 years of age. In addition, the Budget proposes the following requirements and limits:

The value of the ALDA is not included for purposes of calculating the minimum amounts required to be withdrawn from registered plans for the year after purchase

An individual will be subject to a lifetime ALDA limit equal to 25% of the value of all property in the plan (subject to adjustments), and a lifetime ALDA dollar limit of $150,000 from all qualifying plans. This limit will be indexed to inflation for tax years after 2020, rounded to the nearest $10,000

An ALDA must meet several other requirements and conditions

A 1% per month penalty tax will apply if ALDA purchases exceed their ALDA limits

b) Variable Payment Life Annuities (VPLA)

A VPLA will provide payments that vary based on the investment performance of the underlying annuities fund and on the mortality expectation of VPLA annuitants. This option was not previously available and gives PRPP and defined contribution RPP members additional options in creating an income stream in retirement.

Registered Disability Savings Plan -Cessation of Eligibility for the Disability Tax Credit

Registered Disability Savings Plans are used to help Canadian individuals with disabilities save for retirement, provided they qualify for the disability tax credit and other conditions are met. To encourage savings the Government offers grants and bonds (a combined lifetime maximum of $90,000) until the year the individual beneficiary turns 49 years of age. Currently, if an individual beneficiary loses the disability tax credit, by election the account can remain open provided a medical practitioner certifies the DTC is likely to be reinstated based on the nature of the beneficiary’s disability.

The 2019 Federal Budget proposes to eliminate the medical certification requirement including the requirement to close the account when the individual loses the disability tax credit. This will help retain the grants and bonds in the account that would under the current rules be required repaid to the Government. In addition, a tax deferred rollover of a deceased parent or grandparent’s registered retirement account (RRSP/RRIF) will be permitted until the end of the fifth calendar year following the loss of the DTC which is not allowed under the current rules.

The 2019 Federal budget also proposes to creditor protect RDSP’s from seizure in bankruptcy exempt contributions made 12 months prior to filing

If an RDSP beneficiary becomes DTC ineligible the issuer will not be required to close the account on or after March 20, 2019.

Kinship Care Providers

Kinship and close-relationship care programs are alternatives for foster care for children in need of protection.

The Canada Workers Benefit is a refundable tax credit that supplements the earnings of low-income workers and improves work incentives for low-income Canadians.

Effective for the 2019 and subsequent taxation years, Budget 2019 proposes to extend the meaning of a parent of a child to a kinship care provider for purposes of them being able to claim the Canada Workers benefit, provided all other criteria are met. Under the proposals there is no requirement if the caregiver receives financial assistance from a government under a kinship care program.

In addition, financial assistance payments in this capacity are not taxable or used for income tests for benefit and credit eligibility.

Donations of Cultural property

Medical expenses are subject to a 15 per cent non-refundable tax credit exceeding the lesser of $2,352 or 3% of net income. Budget 2019 proposes to extend the meaning of medical expenses to include other classes of cannabis purposed for medical reasons once legal sale is permitted under the Cannabis Act. This measure applies to expenses incurred subsequent to October 16, 2018.

Contributions to Specified Multi-Employer Plan (SMEP) for Older Members

Budget 2019 proposes to amend the tax rules to prohibit contributions to a SMEP in respect of a member after the end of the year the member attains 71 years of age and to a defined benefit provision of a SMEP if the member is receiving a pension from the plan (except under a qualifying phased retirement program). The proposed changes will ensure that employers do not make pension contributions on behalf of older SMEP members in situations from which they cannot benefit. This is more aligned with how other defined benefit RPPs operate.

Individual Pension Plans (IPPs) & Pensionable Service

Upon termination of membership in a defined benefit registered pension plan, the income tax rules allow for a tax-deferred transfer of all or a portion of the commuted value of the member’s accrued benefits in one of two ways, as either a transfer of the full commuted value to another defined benefit plan, or as a partial transfer of the commuted value (subject to prescribed transfer limits within the Income Tax Regulations), to a locked-in retirement savings plan (or similar plan).

Budget 2019 proposes to prohibit IPPs from providing retirement benefits in respect of past years of employment that were pensionable service under a defined benefit plan of an employer, other than the IPP’s participating employer (or its predecessor employer). Any assets transferred from a former employer’s defined benefit plan to an IPP that relate to benefits provided in respect of prohibited service will be a non-qualifying transfer that is required to be included in the income of the member for income tax purposes.

This measure will prevent a member from transferring 100% of their defined benefit plan to a newly created IPP, instead of the restricted transfer of assets to the locked in plan. This measure applies to pensionable service credited under an IPP on or after Budget Day.

Refining Mutual Fund Trust Taxation

When a mutual fund trust disposes of investments to fund a redemption of its units, any accrued capital gain on the investments is realized by the trust and is subject to tax. The unitholder may again be taxed upon the disposition of units on any accrued capital gains. A capital gains refund mechanism (CGRM) provides a refund to the mutual fund trust in respect of tax that the fund had paid on its capital gains attributable to redeeming unitholders. Since the method is based on prescribed formula, it is an approximation and does not always relieve double taxation. Methods have been developed to more effectively match the capital gains realized by the mutual fund trust on its investments with the capital gains realized by redeeming unitholders. However, the Government continues to refine the process to reflect more accurate and fair tax policy and has introduced two new rules in Budget 2019.

Deny a tax deduction to the mutual fund trust to the extent that capital gains triggered in the trust are greater than the capital gain realized upon the redemption of units by the unitholder (subject to meeting certain conditions). This eliminates a tax deferral that existed previously

Deny a tax deduction to the mutual fund trust in respect of an allocation made to a unitholder on a redemption if the allocated amount is ordinary income and the unitholders proceeds are reduced by the allocated amount. This eliminates a character conversion that has been occurring.

These measures will apply to taxation years of a mutual fund trust that begin on or after March 19, 2019.

Carrying on Business in a Tax-Free Savings Account

Effective for 2019 and subsequent taxation years, the 2019 Federal Budget proposes that the joint and several liability for taxes owing on income earned from carrying on a business within the TFSA also be the responsibility of the TFSA holder and not just the trustee (i.e. Institutions) under the current rules. Under the proposals the trustee’s liability is limited to property held in the TFSA and distributions from the date of the notice of assessment.

Tax Credit for Digital Subscriptions

Budget 2019 proposes a temporary, non-refundable 15 per cent tax credit on amounts paid by individuals for eligible digital news subscriptions. This will allow individuals to claim up to $500 in costs paid towards eligible digital subscriptions in a taxation year, for a maximum tax credit of $75 annually. Eligible digital subscriptions include amounts paid to a Qualified Canadian Journalism Organization (QCJO), a status necessary for the non-refundable tax credit.

Measures for Corporations

Business investments in zero emission vehicles

Effective for eligible business acquisitions on or after March 20, 2019 available for use before 2028 (subject to a phaseout) Budget 2019 proposes a CCA rate of 100% for eligible zero-emission vehicles. Subject to certain conditions, passenger vehicles up to $55,000 (plus sales tax) can be fully written off.

To be eligible for the first-year enhancement a vehicle must:

Be a motor vehicle as defined in the ITA;

Would have been included in Class 10, 10.1 or 16;

Be a hybrid (subject to certain criteria) or fully electric;

Small Business Deduction – Farming & Fishing

A reduced rate of tax is available on the first $500,000 of active business income earned by a Canadian-controlled private corporation (CCPC). Existing rules prevent the multiplication of this limit, including situations where certain amounts that are earned by a CCPC come from sales to a private corporation where the CCPC (or certain persons) hold a direct or indirect interest. However, certain income of a CCPCs farming or fishing business that arises from sales to a farming or fishing cooperative corporation is eligible for the small business deduction.

To provide greater flexibility to farming and fishing businesses, Budget 2019 proposes to eliminate the requirement that sales be to a farming or fishing cooperative corporation in order to be excluded from specified corporate income. As such, this exclusion will apply to the income of a CCPC from sales of the farming products or fishing catches of its farming or fishing business to any arm’s length purchaser corporation. However, consistent with the existing rules, amounts allocated to a CCPC as patronage payments from a purchaser corporation will not qualify for this exclusion.

This measure will apply to taxation years that begin after March 21, 2016.

Character Conversion Transactions

New rules introduced in 2013 known as character conversion transactions, effectively eliminated the use of forward contracts as a means of converting the returns on an investment from ordinary income into capital gains, of which only 50 percent is taxable. As a result, any gain that arises from a derivative forward agreement is taxed as ordinary income rather than a capital gain. An important exception to this rule applies to certain commercial transactions, such as merger and acquisition transactions. New character conversion transactions have been developed as an attempt to misuse the commercial transaction exception. As a result, Budget 2019 proposes an amendment that introduces an additional qualification for the commercial transaction exception to ensure that taxation on these transactions remain taxable as ordinary income, and not capital gains.

Possible Changes to Taxation of Employee Stock Options

Employee stock options are provided to employees as an incentive. A stock option grants an employee the right to purchase stocks of the employer at a set price. Once exercised, the difference between the set price and fair market value of the stock is included in the employee’s income as a taxable employee benefit. This benefit however can be reduced by a stock option deduction of 50% of the difference, which has the effect of the benefit being taxed similar to a capital gain. The Federal Government is looking to limit or “cap” the amount of stock options subject to the deduction at a value of $200,000 of the fair market value of the stocks obtained by the option. Any value over the $200,000 (for example in a case of options exercised and worth $300,000) would have the difference taxed as 100% income to the employee. More details will be provided by the summer of 2019.

Previously Announced Measures

Budget 2019 confirms the Government’s intention to proceed with the following previously announced tax and related measures announced on November 21, 2018;

provide for the Accelerated Investment Incentive,

allow the full cost of machinery and equipment used in the manufacturing and processing of goods, and the full cost of specified clean energy equipment, to be written off immediately,

extend the 15 per cent mineral exploration tax credit for an additional five years, and

ensure that business income of communal organizations retains its character when it is allocated to members of the communal organization for tax purposes.

This play on nachos packs a fibre punch.

Perfect for the SuperBowl. This play on nachos packs a huge veg and fibre punch with the added protein of black beans. Tons of flavour, lots of fun, great for a party

Perfect for the SuperBowl. This play on nachos packs a huge veg and fibre punch with the added protein of black beans. Tons of flavour, lots of fun, great for a party

Serves 6

WHAT YOU NEED:

3 medium sweet potatoes, washed and cut into 8 to 10 wedges

1 head cauliflower, cut into florets

1 small red onion, cut into thin wedges

2 tablespoons olive oil

2 tablespoons prepared taco seasoning

½ teaspoon ground cumin

2 cloves garlic, finely minced

1 can black beans, rinsed

1 ½ cups grated cheddar or nacho cheese

Salsa verde (regular salsa will also work)

Plain greek yogurt or Skyr

Prepared guacamole

½ cup crumbled light feta cheese

3 green onions, thinly sliced

Pickled jalapenos

Cilantro

Lime wedges

Hot sauce

WHAT YOU DO:

Preheat the oven to 425ºF and place the sweet potatoes, cauliflower, and red onion onto a large rimmed baking sheet. Drizzle and toss the vegetables with olive oil followed by the taco seasoning and ground cumin. Spread the vegetables into an even layer and bake for 30 to 40 minutes or until the veg are just tender and golden, flipping about halfway through.

Remove the pan from the oven and stir in the minced garlic and rinsed black beans. Return the pan to the oven and bake for another 5 minutes.

Transfer the veg and black bean mixture to a large cast iron skillet and layer on the grated cheese. Place the pan into the oven for another 5 to 10 minutes to melt the cheese.

Top with salsa verde, dollops of the yogurt or skyr and guacamole, and scatter with the feta, green onions, pickled jalapenos, and cilantro. Serve with lime wedges and hot sauce and dig in!

Bonnie McPhail

Investing for success

Around our office we believe in investing for success.

The most important thing to us is that you are completely comfortable with your investments. Part of that means understanding what you are invested in and what risks, if any, you are comfortable with. Saying that even our most seasoned clients can get the jitters when the markets are going down…

Around our office we believe in investing for success.

The most important thing to us is that you are completely comfortable with your investments. Part of that means understanding what you are invested in and what risks, if any, you are comfortable with. Saying that even our most seasoned clients can get the jitters when the markets are going down….especially the ones who lived through 2007/2008!!

We find that our most successful and relaxed (lol) clients are in the correct asset allocation (mix of investments) and we try to match that to suit their comfort level and their goals. Sometimes that can be tricky business!

For anyone that needs a reminder here is a great brochure on how to Invest for Success:

Click here

We love to see our clients succeed!

Jodi

TFSA Limit for 2019

Just announced the new TFSA limit in 2019 will be 6,000 – raised from the current 5,500 in 2018. This means that if you have never contributed

New TFSA Limit for 2019 and other updated amounts

Just announced the new TFSA limit in 2019 will be 6,000 – raised from the current 5,500 in 2018. This means that if you have never contributed to a TFSA (and have been eligible to contribute to the plan) you may be able to deposit $63,500 in 2019.

The current maximum RRSP contribution in 2018 is $26,230 (based on income) in 2019 it will be raised to $26,500

New Tax Brackets in 2019: the basic personal amount for 2019 is $12,069, up from $11,809 in 2018.

OAS Threshold: If your net income exceeds $75,910 in 2018 you will repay part /all of the OAS pension. The amount for 2019 is $77,580

-Jodi

What Exactly is a TFSA (Tax Free Savings Account) ? Should I put money in a TFSA or a RSP?

We have clients that have heard the name but most people don’t know exactly what it is. A common question around our office is “What is a TFSA?” Usually followed by “I thought I could only invest it in a savings account.”

We have clients that have heard the name but most people don’t know exactly what it is. A common question around our office is “What is a TFSA?” Usually followed by “I thought I could only invest it in a savings account.”

Here’s where I usually say “Pretend your TFSA is a box that can hold any type of investment and it can stay in that box tax free and you won’t have to pay tax on anything you take out of the box”…see it doesn’t have to be confusing! And I’m sure my clients are now nodding and saying yes I’ve heard that one before.

Here’s an article to explain more about the TFSA

https://www.fidelity.ca/fidca/en/valueofadvice/gvga/tfsa

Then we most likely will hear “Well should I put money in a TFSA or in a RRSP” Good question and it totally depends on your unique situation. (Yes, in our office every clients situation is unique because no two people’s finances and goals will ever be the same! Kind of like a fingerprint.)

Here’s an article that may help you decide which plan may be best for you.

https://www.fidelity.ca/cs/Satellite/doc/tfsa_compare_rrsp.pdf

When in doubt call us, we will be able to help!

Jodi

Plan for your future. Be your Best Self before you start 2019 #90dayChallenge

This is a Great Idea to work on being your best, and to help plan for it. I think this would benefit anyone at anyone at any age. Whether your Female or Male, in your 50’s or 20’s. We all can take something from this.

Rachel Hollis has started a 90 day Challenge. Now, the actual Challenge started October 1st and takes you to the end of 2018. However, there is no reason you can’t start today or any day for that matter. The idea is improve yourself leading up to 2019, instead of waiting

This is a Great Idea to work on being your best, and to help plan for it. I think this would benefit anyone at any age. Whether you are Female or Male, in your 50’s or 20’s. We all can take something from this.

Rachel Hollis has started a 90 day Challenge. Now, the actual Challenge started October 1st and takes you to the end of 2018. However, there is no reason you can’t start today or any day for that matter. The idea is improve yourself leading up to 2019. Instead of waiting to start working on yourself on January 1st. This way you can already be at a “better you” by the time January 1st comes, therefore you will get further ahead in the 2019 year.

Review the Challenge below I have added a link to Rachel’s site for you to check out.

I believe even if you took one of the “5 to Thrive” Idea’s listed below and added them into your life it would make a difference. For Example “Writing down 10 things you’re grateful for every single day”. I am doing this, and it definitely does give you a different perspective on day to day life, you are always looking for the good.

Someone, posted a message publicly already during the challenge; saying that at the end of the challenge you would have listed 900 things your grateful for. That itself is amazing and inspiring.

Below are the details on how to sign up if you’d like to. It is completely free!

I have also posted a Motivational Message shared from Rachel as well.

I hope you enjoy!

Michelle

Planning for the future- Estate Planning

Many people enjoy taking time off during the summer and hopefully it is while we are having nice sunny days!

In the case that you do experience a rainy day it may be a good time to do some homework on your estate plan.

Many people enjoy taking time off during the summer and hopefully it is while we are having nice sunny days!

In the case that you do experience a rainy day it may be a good time to do some homework on your estate plan.

Pull out your will (if you have one) and make sure it still reflects how you would like your assets distributed.

Here are some things you should consider:

Click here for a Will Planning Checklist

Also use this time to update your personal records. In case of emergency let your loved ones know where you keep your important documents and keep this booklet with those papers.

Click here for Personal Record Keeper

Don’t forget to write in your digital accounts and passwords as well as things like air miles and rewards points.

After all you don’t want your facebook profile living on long after you’re gone.

Happy Planning

Jodi

Summer has arrived!

The kids are done school, and the craziness of summer begins!!

This also means that our Summer Hours are in effect, so we can all enjoy some time with our families.

Our Summer hours for the months of July and August are:

SUMMER IS HERE!!!

The kids are done school, and the craziness of summer begins!!

This also means that our Summer Hours are in effect, so we can all enjoy some time with our families.

Our Summer hours for the months of July and August are:

Monday - Thursday: 9:00 am to 4:00 pm

Friday: 9:00 am to 1:00 pm

Remember:

1) Hope, our receptionist, is here daily from 8:30-5pm. Feel free to drop by if you simply need to drop off or pick up something.

2) If you call on a Friday afternoon after 1:00 pm, we will return your call on Monday.

Enjoy the summer and be safe!

Jodi, Bonnie and Michelle

Going Paperless!

Frequently we are asked... Should I go Paperless?..... How can I eliminate all the paper that comes to my house?

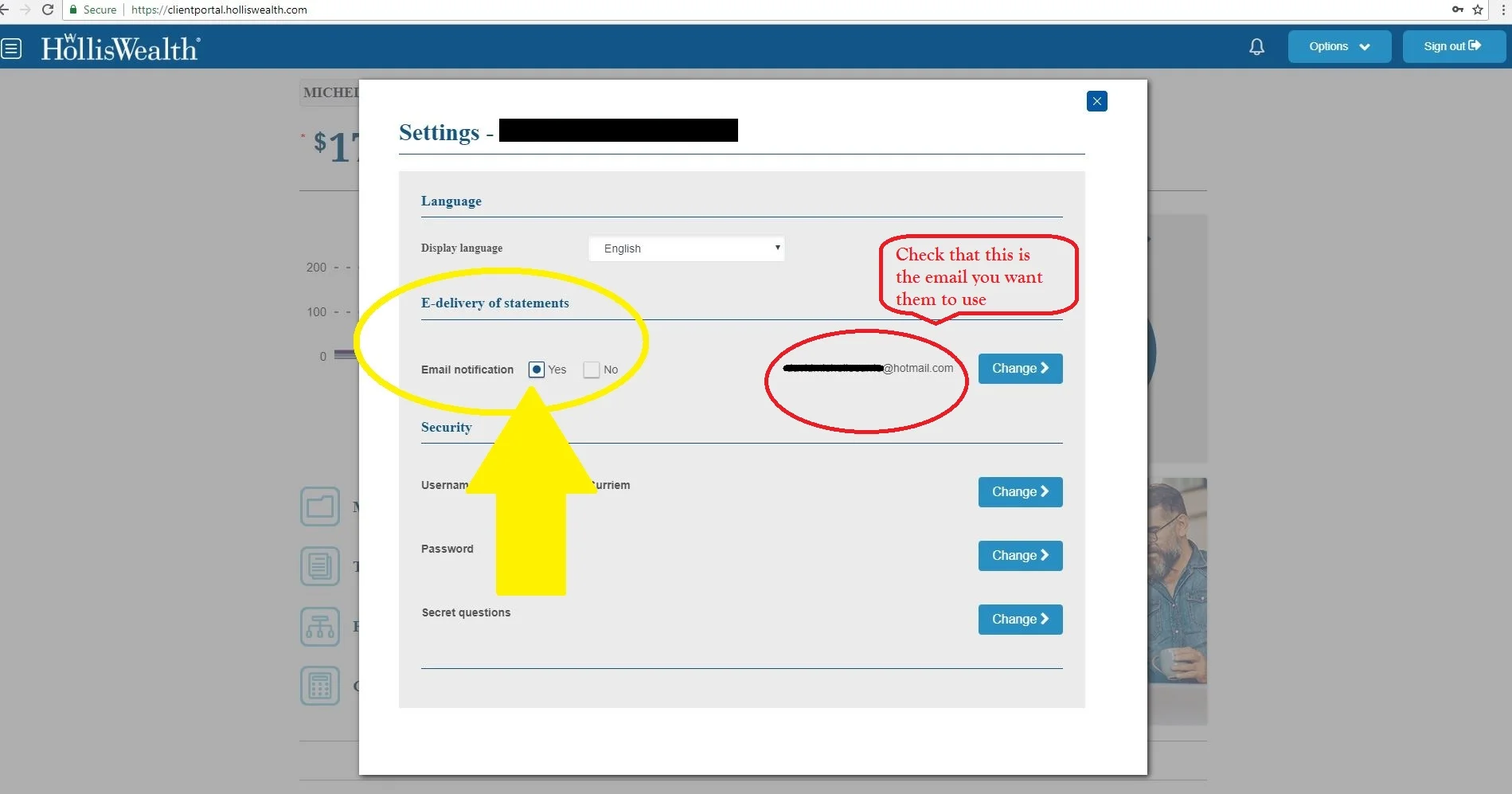

We can help you set up online statements from HollisWealth. (See Below for a Step by Step Tutorial)

We've done some reasearch and here are 3 benefits of going paperless.

1) Help the Environment: Making paper uses a lot of water, a lot of trees and a lot of chemicals. The process also releases some nasty compounds into our air and rivers, including cancer-

Frequently we are asked... Should I go Paperless?..... How can I eliminate all the paper that comes to my house?

We can help you set up online statements from HollisWealth. (See Below for a Step by Step Tutorial)

We've done some research as well and here are 3 benefits of going paperless.

1) Help the Environment: Making paper uses a lot of water, a lot of trees and a lot of chemicals. The process also releases some nasty compounds into our air and rivers, including cancer-causing toxins. By reducing our need for paper, we can make the environment a little bit cleaner.

The typical household sent or received an average of 20 bills, statements and checks per month in 2006. If every household switched from paper billing to viewing and paying bills online, the environmental benefits would be significant.

By making this small change we would:

- Save 16.5 million trees (2.3 million tons of wood).

- Decrease emission of greenhouse gasses by 3.9 billion pounds, the equivalent of taking 355,000 cars off the road.

- Reduce fuel consumption by 26 million BTUs.

2) Decrease Clutter: Going paperless provides a fantastic opportunity to organize the paper that's currently cluttering your home office and kitchen counters. To get rid of paper documents, you'll first make electronic versions of them. The process requires an initial investment of time, but in the long run your documents will be easier to find. What's more, you'll eliminate clutter, which can save you time on a daily basis.

3) Gain Security: A paperless lifestyle involves a lot of backups. You can save documents on your computer hard drive, an external hard drive, removable media such as CDs or DVDs, or an online data storage center similar to the cloud. This way if disaster strikes, you'll have a better chance of recovering paperless documents than their paper counterparts.

We've taken some snap shots as a Tutorial to help you receive the HollisWealth / Investia Statements electronically. Please see them below.

We've taken some snap shots as a Tutorial to help you receive the HollisWealth / Investia Statements electronically. Please see them below.

( PLEASE NOTE YOU MUST HAVE already registered for online access. If you have not yet done so, please follow the Blog titled " Registering for HollisWealth ONLINE ACCESS TODAY")

That's it!, It was that simple :)

Now you can keep going if you like. You may register to go paperless with each of the Fund Companies you're invested with.

You may find instructions on your current statements advising you how this can be done.

If your having trouble, or if you find it easier, each company will also walk you through the process over the phone.

I have included some fund company Phone #'s here as a directory, if i am missing a phone # you need feel free to call us at the office.

*Before you call make sure you have their account # for your account with them, the rest of the security questions should be simple such as your name, your financial advisors name, your home address etc.

AGF Mutual Funds: 1-800-268-8583

B2B Bank: 1-800-263-8349

CI Investments: 1800-563-5181

Dynamic Mutual Funds: 1-800-268-8186

Edgepoint: 1-866-818-8877

Fidelity Investments: 1-800-263-4077

Franklin Templeton: 1-800-387-0830

IA Clarington: 1-888-860-9888

Invesco: 1-800-874-6275

Mackenzie Investments: 1-800-387-0614

Manulife: 1-888-790-4387

If you have any questions, please contact our office.

Michelle Currie

Simplify preparing for Income Tax Time

This time of year we always receive a lot of calls, for missing tax slips, or for those who want to receive their slip early to file their taxes early...............We want to help simplify this process for you.

...........My Account is an easy option to help you! It will allow you to track your refund, view or change your return, check your benefit and credit payments, view your RRSP limit, as well as your TFSA Contribution limit. You can set up direct deposit, receive online mail, and so much more

We would like to help you simplify your time while preparing for taxes this year! Here we have a few things for you to keep in mind.

During this time of year we always receive a lot of calls, for missing tax slips, also clients looking for some of their tax slips early hoping they can file their taxes early.

Here's something to keep in mind. In our Feb 2, 2018 Blog we have a couple lists, as well as the deadline for some tax slips. Note: The deadline for some slips is not until the end of March.

For those of you who would like to simplify life. We suggest registering for My Account an Online site with CRA. This will help to ensure that you have all your investment tax slips as well as any T4's and more, see below for a overview of the options available.

My Account is an easy option to help you! It will allow you to track your refund, view or change your return, check your benefit and credit payments, view your RRSP limit, as well as your TFSA Contribution limit. You can set up direct deposit, receive online mail, and so much more.

If you are registered with My Account, you can also use Auto-fill my return when you file online using certified software.

On your mobile device? Try the MyCRA mobile app - you can securely access key parts of your tax information and manage personal details, wherever you are.

Michelle Currie

2018 Federal Budget Summary

In order to keep you up to date on the proposed changes in the Federal Budget you may want to click on this document to see how they may affect you.

In order to keep you up to date on the proposed changes in the Federal Budget you may want to click on this document to see how they may affect you.

Click here

Jodi Dark

A comment on the recent -Market Correction -

A comment on current market volatility from Fidelity’s Jurrien Timmer Director of Global Macro for Fidelity Management & Research Company

“Whether last week's correction ended on Friday or continues for days or weeks to come is of course unknowable. My guess is that the market chops around for a while, perhaps several months, as typically happens after the economy reaches a momentum peak. For the typical investor, it's worth remembering that part of the value

A comment on current market volatility from Fidelity’s Jurrien Timmer Director of Global Macro for Fidelity Management & Research Company

“Whether last week's correction ended on Friday or continues for days or weeks to come is of course unknowable. My guess is that the market chops around for a while, perhaps several months, as typically happens after the economy reaches a momentum peak. For the typical investor, it's worth remembering that part of the value of the stock market is that over the long run, equities generate better returns than less risky investments (like money market funds or bonds) but that the "cost" of those higher returns is higher volatility. In that respect, nobody should view the 52% return for the S&P 500 over the last 2 years—amid record low vol—as normal.

So I for one am not concerned that the stock market is starting to behave like its normal self again. And for investors with an appropriate investment plan based on their risk tolerance, goals, financial situation, and timeline, short-term volatility shouldn't require any action. More active investors may actually welcome this volatility. I myself am relieved actually. Better a correction now than a bear market later.

Corrections are like vegetables in that sense. They don't always taste good, but they can be good for you.”

Jodi Dark

As the old saying goes "The only two things in life that are certain are death and taxes"

This is the time of year when we have many calls from clients asking when they can expect their investment receipts.

Below is a timeline what investment slips to look out for and when they are typically mailed out.

This is the time of year when we have many calls from clients asking when they can expect their investment receipts.

Below is a timeline what investment slips to look out for and when they are typically mailed out.

Regulatory deadlines

T4 – February 28th/29th

T5 – February 28th/29th

T3 – March 30th

T5013 – March 31st

NR4 – March 31st

Contribution Receipts – Contributions made in the first 60 days of the year are mailed daily while contributions for the remainder of the year are mailed in January of the following year.

If you own open or non registered investments please keep your year end receipts as your accountant may need these to calculate any capital gains

Also click here for a one pager that lists some of the things you should think about collecting in order to get all of the tax breaks you may be eligible for.

Helpful one page checklist

Happy Calculating!

Jodi Dark

Client Appreciation Shred Day

This Year we offered a Shredding service as a Client Appreciation THANK YOU to our clients!

This year we offered a shredding service as a Client Appreciaton. THANK YOU to all our clients who brought in their shredding, we may have to do this again next year!

Michelle Currie