News

We have some exciting changes coming to our office that we want to share with you.

The first thing you may notice is that we are changing our email addresses.

As you can see above and right here, are our new contact emails:

Jodi Dark

jodi@financialbydesign.com

Michelle Currie

michelle@financialbydesign.com

Bonnie McPhail

bonnie@financialbydesign.com

We have some exciting changes coming to our office that we want to share with you.

The first thing you may notice is that we are changing our email addresses.

As you can see above and right here, are our new contact emails:

Jodi Dark

jodi@financialbydesign.com

Michelle Currie

michelle@financialbydesign.com

Bonnie McPhail

bonnie@financialbydesign.com

This small change is just one part of continuing the branding of my personal, corporate name which is Financial by Design. Financial by Design is my corporate name that we have had, and used for 5 years. We are now choosing to use this brand for our email address

Next up-----OFFICE Renovation—follow along with our progress

If you haven’t been following us on social media you will be able to find us on all platforms by searching Financial By Design.

Home Office - Lockdown - eligible deductions

Now that we are deep into our emergency COVID lockdown you may find this link useful if your employer is requiring that you work from home.

Now that we are deep into our emergency COVID lockdown you may find this link useful if your employer is requiring that you work from home.

Click below to find out if you are eligible to deduct your home office as an expense while you are an employee working from home. As well the CRA has added a list of new expenses that can be deducted.

https://www.canada.ca/en/revenue-agency/news/2020/12/simplifying-the-process-for-claiming-a-deduction-for-home-office-expenses-for-employees-working-from-home-due-to-covid-19.html

The TFSA new contribution limit for 2021

The TFSA new contribution limit for 2021 has been officially released. That limit is $6,000, matching the amount set in 2019 and 2020.

⠀⠀⠀⠀⠀⠀⠀⠀⠀

The limit is $6,000, matching the amount set in 2019 and 2020.

⠀⠀⠀⠀⠀⠀⠀⠀⠀

Merry Christmas

Merry Christmas - From all of us to all of you

It’s the season to be jolly!

Jodi Bonnie and Michelle

Welcome to part 2 of Our Small Business Info Series

This week we continue expanding your knowledge on the types of business you may choose to operate.

𝐏𝐚𝐫𝐭𝐧𝐞𝐫𝐬𝐡𝐢𝐩 – a business that you start with someone else. Could be a friend, a spouse or life partner, or someone you just met, and you have a great business idea together.

This week we continue expanding your knowledge on the types of business you may choose to operate.

𝐏𝐚𝐫𝐭𝐧𝐞𝐫𝐬𝐡𝐢𝐩 – a business that you start with someone else. Could be a friend, a spouse or life partner, or someone you just met, and you have a great business idea together. Could be 2 or more partners, doesn’t matter. A partnership does not have to be a 50/50 split. You can decide the percentages based on money contributions, work, property or skills brought to the partnership. It can be formed with a contract or a verbal agreement, but you should set the terms for entering and leaving the partnership, division of income and other stuff. It’s kind of like a marriage, things always start out rosy and hopefully they stay that way. However, I want you to go in with your eyes wide open and plan for the worst-case scenario – have all of the terms written out so if things go south everyone is protected.

The partnership does not have to file a separate income tax return. Instead each partner includes their share of income or loss on their personal tax return. Each partner needs to file a T1 tax return and a form T2125 Statement of Business or Professional Activities.

Jodi

𝐒𝐦𝐚𝐥𝐥 𝐛𝐮𝐬𝐢𝐧𝐞𝐬𝐬 𝐛𝐚𝐬𝐢𝐜𝐬

During these last few months, we’ve noticed that some of our clients have been looking into alternative business opportunities or side hustles as we like to call them.

During these last few months, we’ve noticed that some of our clients have been looking into alternative business opportunities or side hustles as we like to call them.

I’ve decided to start a 𝘚𝘮𝘢𝘭𝘭 𝘣𝘶𝘴𝘪𝘯𝘦𝘴𝘴 𝘐𝘯𝘧𝘰 𝘚𝘦𝘳𝘪𝘦𝘴 to help you with the boring, (hopefully not too boring) but necessary info that you should know if you are starting yours. It will make things a lot easier down the road if you are aware of all the things at the beginning.

Let’s start with some basic knowledge on the types of business you may choose to operate.

𝐒𝐨𝐥𝐞 𝐩𝐫𝐨𝐩𝐫𝐢𝐞𝐭𝐨𝐫𝐬𝐡𝐢𝐩 – a business that you and you alone own, it’s your baby and everything belongs to you. Another word for this is self-employed. You make all the decisions, make all the money and assume all the risk. You pay the income tax on all the profits and include this on your personal tax return. If you have outstanding debts, creditors can come after your personal assets.

Your business can be set up in your name, or you can operate under a business name. If you choose to use a business name, then you should set up a bank account in that name and you may also want to register the name and get a business number. You will need a business number if you have a payroll or need to collect GST/HST.

You will need to pay tax on any income that your business has earned and you may have to make Canada Pension Plan (CPP) on that income.

At tax time you will need to file a T1 tax return and a T2125 form which is a statement of business or professional activities.

Check back next week for part 2 of our 𝘚𝘮𝘢𝘭𝘭 𝘣𝘶𝘴𝘪𝘯𝘦𝘴𝘴 𝘐𝘯𝘧𝘰 𝘚𝘦𝘳𝘪𝘦𝘴!

Jodi

Electronic Signature

Digital / Electronic Signature is NOW an Option for you.

How can I set this up?

If you are interested in this option the next time you need to complete a transaction, please let us know.

If you have registered online for Client Portal, you are already over halfway there.

Do I have to register for Client Portal?

No, you do not. This process can be done through your email.

Digital / Electronic Signature is NOW an Option for you.

We are excited to be sharing some amazing news.

We can now accept Digital Signatures😊

How can I set this up?

If you are interested in this option the next time you need to complete a transaction, please let us know.

If you have registered online for Client Portal, you are already over halfway there.

Do I have to register for Client Portal?

No, you do not. This process can be done through your email.

What is a Digital Signature? Do I sign my name with my finger or my mouse?

Your digital signature is simply a secure stamped document. It contains details such as your name, the date and time. Once a document is digitally signed it can not be altered. SO, there is no signing with your mouse or finger needed.

Is the process difficult?

No, the process is quite simple. You will receive an email that you have a secure document to sign. You may choose to sign it via email or by logging into your Client Portal. You will be walked through each step and will have a chance to review the entire document prior to “Clicking” to digitally sign/ accept the document.

Is it secure?

Yes, the document can not be opened to view it with out either a 4-6-digit Verification Code that you may choose to have text to you

OR

The other option instead of a text, is to have a secret question and answer (we will set that up together prior).

Does the Digital Signature process take a long time?

No. For a first-time user I would give yourself 10 mins, but if you are familiar with similar processes it simply takes a few mins.

What if I find an error and don’t want to sign the document because it or the data within it is incorrect?

You have the option to decline and give an explanation as to why you are not able to sign the document the way that it is.

Can I sign everything Digitally from now on?

We like to see you at least once a year.

However, the answer is Yes if we have previously met with you, identified you and have obtained an original signature to start with, most everything can be signed digitally. However, we want to see you a minimum of once a year😊

I forget what I signed; how can I see it again to review it?

The digitally signed documents are always available to you. When you log in to your Client Portal, the documents will be available for you to see forever. We can email you the completed form to keep on file if you like.

We keep everything on file here for you to see them anytime.

If this option seems of interest to you. Let us know! We are always here to help.

- Michelle

Electronic Funds Transfer

EFT- Yes this is Available!!!

First of all what is an EFT.

Electronic funds transfer (EFT) represents the process of money transfer from one bank account to another usually through an electronic system (computer with access to internet) without any involvement of bank managers. You can use abbreviation EFT when you speak about several payment systems….

Read More to see How You can Get Started Today!

EFT- Yes this is Available!!!

First of all what is an EFT.

Electronic funds transfer (EFT) represents the process of money transfer from one bank account to another usually through an electronic system (computer with access to internet) without any involvement of bank managers. You can use abbreviation EFT when you speak about several payment systems:

Debit/credit card payments for a product/service

Direct deposit payment from the payer

Direct debit transaction

International bank payment using wire transfer or any other form of electronic transfers

Electronic bill payment, issued by the bank via online banking

Any financial transaction performed by bank or electronic money (e-Wallets) issuer where no cash is involved

How can You get Started?

The process is simple.

1) Contact Michelle or Bonnie to let them know you are interested in this option

2) We will Send you an email with A EFT PDF to help guide you through the process, as well as provide you with your Personal Account #. Once you receive your personal account # from us you are all set.

3) Login in to your online bank access and set up a New Payee.

4) Choose Investia Financial Services Inc.

(If this is not available for you there are 2 options

i) Contact your Branch ii) Search for HollisWealth

5) Indicate your Account # provided by us

6) Send the $ to your Investia account, as per the Account # provided by our office

Things to remember

1) Let us know when your sending the $, and the amount.

2) Let us know if you will be coming into sign a form for the deposit or if you would like us to send you a form so you may digitally sign it!!! (Yes, this is a NEW option too)

3) Remember it takes 24-48 hours for the $ to appear at our Head office Investia

These Tips are also available in a Video on Facebook or Instagram

Be sure to reach out to us if your interested or have more questions!

- Michelle

A Word from Our Partners

With everything that is happening in the world, now is a good time to step back and think about where we are and where we might be going. There is a tremendous amount of information available. But what’s missing is a framework for that information that would help clarify the big picture. ..

How To Think About The Corona virus Pandemic: The Big Picture

March 17, 2020 • Brad McMillan

With everything that is happening in the world, now is a good time to step back and think about where we are and where we might be going. There is a tremendous amount of information available. But what’s missing is a framework for that information that would help clarify the big picture.

What I want to do today is outline how I see that big picture, which will hopefully provide a framework to understand where we are headed. In the next couple of days, I plan to go into more detail on the individual components.

Breaking Down The News

First, we have to break down the news. There are three different issues that we need to consider, and the news often conflates them. The issues are (1) the virus itself and the pandemic, (2) the economic impact of the pandemic, and (3) the financial market implications of that impact. By considering them individually, we can gain some clarity.

The virus itself.

The base question is whether the virus is controllable or not. And the answer is yes. In the absence of restraints, the virus will spread—as we saw in China, in Italy and in the U.S. But when proper restrictions are put into place, it can be brought under control. This idea has been proven in China and South Korea, and Italy is now reportedly stabilizing. Here in the U.S., we understand what has to be done, and we are now doing it. This is the end of the beginning.

Unfortunately, we are not out of the woods just yet. Everyone now knows what to do and why, as well as what the stakes are. If we just stay home, things will eventually get better. But there is usually a lag of about two weeks between the time that restrictions are put into place and when new cases stabilize. So, we can expect the news here to get worse for a while. We are likely past the point of maximum danger, but we are not past the point of maximum impact. Even as the rate of spread slows, expanded testing will make it look like things are getting worse. Expect to see that story in the headlines.

The economic impact.

The economic damage is certainly real. But going forward, the question is whether the next year will look like it did after 9/11—or like 2008.

Right now, the resemblance to 9/11 is much greater. The pandemic is an outside shock to the economy, which has generated fear and will slow consumer and business spending, much like 9/11. As such, like 9/11, the economic impact could pass once the fear does. That is the base case: real damage, but then a recovery as confidence returns. The economic impact will, however, likely be worse than after 9/11. The slowdown in spending is very likely to be worse and longer lasting this time, which could (over time) turn the 9/11 into another 2008.

This scenario is something we must keep in mind, but whether it happens will depend on whether government policy is sufficiently supportive to both workers and businesses affected by the drop in demand. Here, the news is good. The Fed acted fast and hard to provide monetary stimulus. Unlike 2008, the Fed has clearly stated it will do what it needs to do in order to avoid a crisis. The federal government is also in the process of responding with economic support. While that process is not yet complete, signs are that any necessary support will be available, minimizing the chances of another 2008. There will be economic damage, but with proper policy support, it is likely to be limited.

Financial market implications. Finally, when we look at the markets, we see a clear expectation that the pandemic will continue and that the economic damage will be substantial. While that still may end up being the case, policy actions both here and around the world have made that substantially less likely in the past week. Signs are that the pandemic will be brought under control and that the economy will get enough support to weather the storm. Make no mistake, there will be damage. But from a market perspective, the question will be whether the damage is greater than markets now expect, or less. Signs are that the damage will be less, which should support markets going forward and eventually enable a recovery.

What Happens Next? The crisis is not over. We can certainly expect the headlines to keep screaming and even get worse over the next couple of weeks, which could keep markets turbulent. We know, however, what is needed to solve the problem and that those measures are largely in place. By keeping the framework discussed here in mind, we will be prepared for those headlines and able to see the gradual improvement underneath them.

This is a difficult time for everyone, and worries are surging. Although those worries have allowed for the necessary policy changes to solve the problem, worry is always difficult. As we move forward, keep in mind that while the concerns are real, so is the policy progress. In the not-too-distant future, we are likely to see the virus brought under control here just as we have seen in other countries. Keep calm and carry on.

Brad McMillan is the chief investment officer at Commonwealth Financial Network.

January 26th-National Spouses Day

January 26th is National Spouses Day

National Spouses Day is observed annually on January 26.

Dedicated to recognizing spouses everywhere, National Spouses Day reminds us to take time for our mate. From being thankful for fulfillment and security of a long-term relationship to the boost of morale and well-being provided by spouses, there are many reasons to celebrate. This day is a time to show your spouse that you care and appreciate all of the things that he or she does for you and the home.

Life gets busy, and we can often take for granted how our spouse improves our life. Pay a heartfelt thank you or compliment to the love of your life. National Spouses Day is a non-gift giving day, so spend time together and reconnect. Don’t forget to say, “I love you.”

HOW TO OBSERVE

If it has been a while since you have expressed appreciation to the partner you walk beside, now is your chance. Again, this day is not about giving gifts but spending time together, enjoying each other and appreciating each other. Use #NationalSpousesDay to post on social media.

Bonnie

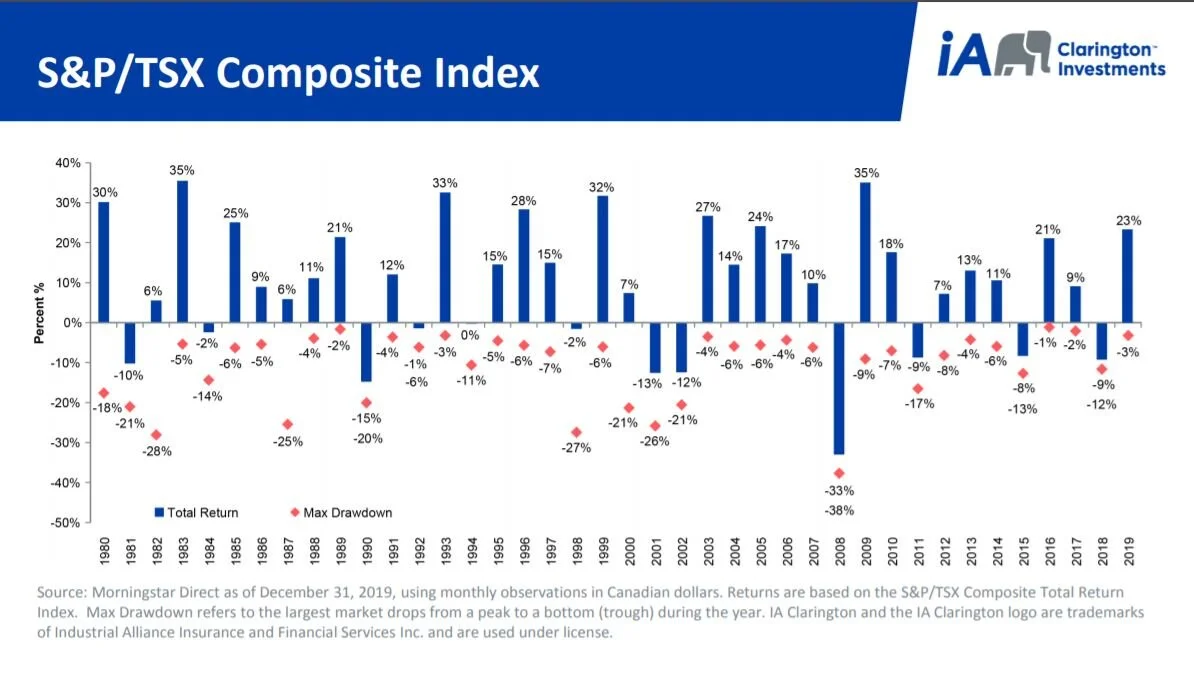

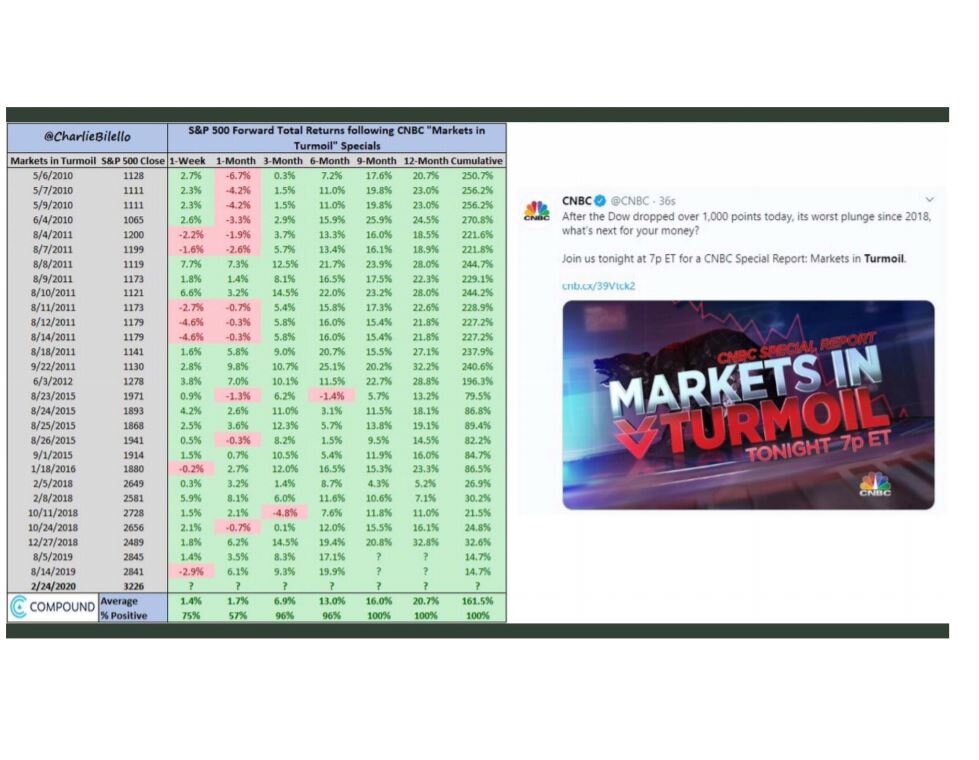

20 Year Trends Retrospective

Looking Back

Sometimes when the world feels like it's going a little crazy, it's good to look back and see how far we've come…..

Looking Back

Sometimes when the world feels like it's going a little crazy, it's good to look back and see how far we've come and what we have walked through.

This is a good example of how historic events have affected markets and how they march on despite it.

-Jodi

Learn to save a life

Cardiac arrest can strike anytime, without warning. By acting fast you could save a life.

Our office just completed a Heart and Stroke CPR course!

If you’re still cooking up your resolutions for the new year, we have a humble suggestion for you: add CPR training to your list. CPR helps keep blood and oxygen flowing and dramatically increases the chances of survival in those who suffer a cardiac arrest.

The Life You Save May Be That of a Loved One.

Did you know that four out of five cardiac arrests occur at home? Not only that, but many victims of sudden cardiac arrest appear healthy and may not have any known heart diseases or risk factors. Performing CPR promptly may save the life of someone you love.

Prevent Brain Death

Brain death occurs four to six minutes after the heart stops breathing. CPR effectively keeps blood flowing and provides oxygen to the brain and other vital organs, giving the victim a better chance for full recovery. Everyday Health reports that If CPR is given within the first two minutes of cardiac arrest, the chances of survival double.

CPR Makes You Smarter

Let’s face it, by the time you complete CPR training, you’ll know something that you didn’t know before you started!

You’ll Feel Confident in the Event of A Cardiac Emergency

By nature, CPR classes are hands-on and interactive. While there may be some online training involved, course participants will learn how to properly execute chest compressions in a fun and supportive environment.

You’ll Test Your Musical Knowledge

The tempo at which you should give chest compressions lines up nicely with popular musical gems such as the Bee Gees’ “Stayin’ Alive,” “Walk Like an Egyptian” by the Bangles, and “Save a Horse (Ride a Cowboy)” by country duo Big and Rich.

Join the 3 Percent

“Although evidence indicates that bystander CPR and AED use can significantly improve survival and outcomes from cardiac arrest, each year less than 3% of the.population receives CPR training, leaving many bystanders unprepared to respond to cardiac arrest.” Become a part of the solution and sign up for a CPR training course today.

Bonnie

Four Always, Four to Avoid

Learn to save a life!

Based on our research with Blue Zones Centenarians, the healthiest, longest-lived people in the world, we created these simple food guidelines to help people live better. Although the blue zones longevity hotspots were in very different parts of the world, they had similar eating patterns and lifestyles.

These are the four best foods to always have on hand and the four worst foods to avoid. The Always Foods are readily available, affordable, taste good, and are versatile to include in most meals. The Avoid Foods are those highly correlated with obesity, heart disease, or cancer, as well as constant temptations in the standard American diet.

Bonnie

IT'S JUST A BOX

We love what we do and we love to make the complicated easy to understand.

I get A LOT of questions regarding types of investment plans. People will come in to see us for the first time, we will be chatting about things like their investment experience and investments they currently own and inevitable this is how it goes:

Hey There

We love what we do and we love to make the complicated easy to understand.

I get A LOT of questions regarding types of investment plans. People will come in to see us for the first time, we will be chatting about things like their investment experience and investments they currently own and inevitable this is how it goes:

They’ll say “I have a RRSP” and I’ll say so what is it invested in and 95% of the time they will say “I don’t know… it’s a RRSP”.

Here’s the thing… a RRSP is just an investment vehicle/a type of account. Here’s how I like to describe it:

I like to say it’s just a box. Picture types of plans as boxes. You can have a RRSP (Registered Retirement Savings Plan) box, a RESP (Registered Education Savings Plan) box, a TFSA (Tax Free Savings Account) box etc.

Any type of investment can go into any of these boxes.

Let’s take a RRSP as our example:

IT”S JUST A BOX! 😊

As always let us know if you have any questions or I you want to learn more.

Jodi

Our Summer Hours Have Arrived

Reminder we start our Summer Hours this week.

For the Months of July and August.

They are as follows:

Monday - Thursday 9:00 am to 4:00 pm

Friday's 9:00 am to 2:00 pm

Some important points to remember:

1) If you call on a Friday Afternoon after 2:00pm we will return your call on Monday Morning.

2) As always exceptions will be made. If you need a meeting after hours we will be more than happy to accommodate your request.

Enjoy the awesome summer and be safe!