Travelling out of Country this Year: Here are the changes to OHIP that you need to be aware of:

Starting January 2020 the Ontario government’s OHIP coverage for some types of out of country medical costs has changed or been eliminated. While the previous emergency coverage was

Starting January 2020 the Ontario government’s OHIP coverage for some types of out of country medical costs has changed or been eliminated. While the previous emergency coverage was minimal - a maximum of $400 per day, this coverage has now been eliminated. It will now be the travellers sole responsibility to cover any medical costs associated with out of country treatments while travelling. Keep in mind the past coverage of $400/day would not typically have covered the cost of a trip to the emergency room in the US which averaged at a cost of over 2,000/ visit.

If you will be travelling it is important to research and get private coverage NOW more than ever.

First you should explore any existing coverage that you may already have. This coverage could be through an employer sponsored extended health care plan, a program offered through your credit card or any private coverage that you may already have or that is available to purchase.

All programs differ in coverage and in cost so it is important to read the fine print to see which one best applies to you and your family. Don’t forget that some policies will not cover you for what they may determine as “risky behaviors”, such as bungee jumping or scuba diving.

It is also very important to be totally honest when applying for private coverage. Depending on your age you may be asked health questions which will help determine the cost of your coverage. Obviously the better health you are in the lower the cost will be. Please note that in case of a claim, the insuring company WILL check back on your medical records to make sure you did not have a pre-existing condition that was related to your emergency while travelling and they WILL deny your coverage.

Most companies will also state that you need to call their 1-800 number BEFORE you seek any treatment or they may not cover your costs.

To make it easy for our clients to obtain a quote for travel insurance we offer a link on our website to the Manulife travel insurance HERE.

We encourage you to shop around as this coverage may not be the best plan available for you and your family. It’s important to read the fine print. We encourage you to look at all of your options!

Below we have included links to a summary of the changes published by the Globe and Mail and also a link to the OHIP website for further research.

Click Here to see in the link from the Globe and Mail

Click Here to see the link from Ontario Government OHIP

-Jodi

Tax Free Savings Accounts - 2020 Contribution Limit and more

The TFSA new contribution limit for 2020 is $6,000, this is the same amount set for 2019.

Do you want to start a TFSA? Have your taken withdrawals from your TFSA?

What is the age I can start a TFSA? Breakdown of the TFSA Annual Dollar Limits by Year

What is the 2020 TFSA Contribution Limit?

The TFSA new contribution limit for 2020 is $6,000, this is the same amount set for 2019.

Do you want to start a TFSA?

If you don’t have a TFSA yet then total contribution room available in 2020 for someone who has never contributed and has been eligible for the TFSA since its introduction in 2009 is $69,500.

Have you taken withdrawals from your TFSA?

For those clients who have withdrawn from their TFSA and want to know what their limit is now. One thing to keep in mind is the crystallized gains and losses from the withdrawal(s) are factored in to their TFSA room.

Here’s the formula:

Unused TFSA contribution room to date + total withdrawal made in this year + next year’s TFSA dollar limit = TFSA contribution room at the beginning of next year

( Click here to see CRA rules on making or replacing withdrawals)

What is the age I can start a TFSA?

Anyone 18 or older who has a valid social insurance number is eligible to open a TFSA. Contribution room accumulates beginning in the year in which a person turns 18.

Breakdown of the TFSA Annual Dollar Limits by Year

For 2009, 2010, 2011 and 2012: $5,000

For 2013 and 2014: $5,500

For 2015: $10,000

For 2016, 2017, and 2018: $5,500

For 2019 and 2020: $6,000

Total: $69,500

For Information on

TAX FREE SAVINGS ACCOUNTS- ARE THEY TAXABLE UPON DEATH? WHO SHOULD I NAME AS A BENEFICIARY? Click here to review our recent Blog

-Michelle

Yoga as a Remedy for Our Stressed, Sedentary Digital Age

Yoga can help to alleviate the stress, anxiety, and aches and pains that come with the digital age. Here are some yoga moves you can do anywhere, even at work.

Yoga can help to alleviate the stress, anxiety, and aches and pains that come with the digital age. Here are some yoga moves you can do anywhere, even at work.

Most of us spend the majority of our days on our phones, computers, tablets, and in front of our TVs. We also spend the majority of our days sitting or reclining, whether in our cars, at our desks, or on our couches. Just as humans are not meant to be wired all the time, we are not meant to be sedentary for most of our days. It’s not a coincidence that we are restless, stressed, anxious, and suffer constant back and pains.

Office, Desk, or Cubicle Yoga: 4 Essential Moves to Reverse “Computer Crouch” and “Mouse Arm”

For a typical office job of answering telephones and working at a computer, there are a couple of poses that you should do often.

Every 15 Minutes, Sitting Moves:

1. Elbow Hold:

Put your arms up over your head and hold your opposite elbows. Then move your held elbows in four directions: forward and backwards, from side to side, and in small back and forward bends. Do this for 20-30 seconds every 15 minutes.

2. Arm Twists:

Put your arms straight out to the sides with your thumbs up. Rotate our arms forward and then backwards so your thumbs are moving in a circular motion. Do this 10 times. Then repeat with your arms rotating in opposite directions from each other. Do this 10 times as well.

Every 30 Minutes, Standing Moves:

1. Baby Backbends: Stand up and clasp your hands behind your back. Arch backwards gently as you open your chest and roll your shoulders back and behind you. Then turn your head side to side, 5 times. Then bend your ear towards your shoulder, 5 times on each side.

2. Arm Circles: Put your right hand on your right shoulder. Extend your left arm straight out to the side and bend your wrists so your fingers point towards the floor. Move your left arm around in a circle about 5 times each way. Then repeat this on your right side.

Changing Career Paths

So, if you are contemplating a career change, you’re not alone. And whether a leap into another profession is by choice or necessity, smart financial planning can help protect…..

How Often Do People Change Careers? Experts like to talk about how often people change careers during their lifetimes. This figure usually ranges from between three and seven times. Sometimes the change is by choice, and sometimes there is a factor in place.

When Workopolis recently asked Canadians how many career paths they had followed, just one in four replied “one.” A clear majority had switched directions at some point – whether because they had discovered a new field they felt passionate about, or because they hit roadblocks such as alack of advancement, cutbacks or layoffs

So, if you are contemplating a career change, you’re not alone. And whether a leap into another profession is by choice or necessity, smart financial planning can help protect your household budget and keep you on track towards a comfortable retirement.

-Jodi

A Photo book for every memory and occasion

A Photo Book For Every Memory And Occasion

Upload Photos From Anywhere

Upload photos from your computer, Facebook, Instagram. Keep them for FREE on Mixbook for as long as you want.

Start As Many Projects As You Want

Create Personalized Photo Books and Albums of Incomparable Quality

Upload Photos From Anywhere

Upload photos from your computer, Facebook, Instagram. Keep them for FREE on Mixbook for as long as you want.

Start As Many Projects As You Want

Mixbook is FREE to use and there are no contracts or subscription fees. You only pay for the printed books you order.

Explore Themes

Your Book, Your Way

Choose your preferred format, size and cover style, and we'll take care of the rest! You'll be delighted when your books arrive and have a lasting keepsake for years to come.

When do I have a capital gain and what is an ACB?

When you sell an investment that has increased in value you may realize a capital gain. As an investor you realize this gain when you sell all or part of your investment. The gain is calculated when you subtract the selling price of the investment from your ACB (Adjusted Cost Base).…..

When do I have a capital gain and what is an ACB? (This is for Non Registered Accounts only)

When you sell an investment that has increased in value you may realize a capital gain. As an investor you realize this gain when you sell all or part of your investment. The gain is calculated when you subtract the selling price of the investment from your ACB (Adjusted Cost Base). The ACB isn’t always the purchase price but is the amount of the investment that has already been taxed. If you’ve received a distribution from your investment at any point when you have owned it you will have been taxed on this in the year you received it. This will then increase your ACB. This prevents you from being taxed twice on a gain.

You may also incur a capital gain if a fund manager sells an investment that has gone up in value. In this case the fund realizes a capital gain (which is calculated the same way as above), this gain flows through to the investors holding the fund. As a result you may receive a tax slip for these gains even though you did not sell any of your investment. This will increase your ACB so once again you will not be taxed twice on these gains.

Your ACB can change if you:

Buy units of the same fund at different times. Your cost will then be averaged out which will affect your ACB.

You receive a distribution. It won’t matter if you receive this distribution or reinvest it, you will still be taxed in the year you receive it.

You receive return of capital. This occurs if your investment pays you a return of capital, this portion is not taxable to you because you’re taking your own money out, therefore when you sell your investment any return of capital is subtracted from your ACB which will increase your capital gain.

Any questions please give us a call.

Jodi

Overcome a lack of confidence about money and investing

It’s an everyday occurrence around our office. Women come in and apologize to us for their lack of investment knowledge. All I have to say is “ladies, you’re not giving yourself enough credit. You know more than you think!”

It’s an everyday occurrence around our office. Women come in and apologize to us for their lack of investment knowledge. All I have to say is “ladies, you’re not giving yourself enough credit. You know more than you think!”

I find that in order for women to feel confident they need to have a lot of knowledge on a subject.

Here’s an article listing 5 things to help overcome a lack of confidence about money and investing.

https://www.fidelity.ca/cs/Satellite/doc/tl_women_and_money.pdf

You Go Girl! You Got This!!

Jodi

All your years of hard work and determination paid off!

Congratulations Bernie, All your years of hard work and determination paid off!

Read the article here to find out all about it.

Bernie dropped into the office today to show us his Gold-Medal.

—Read the article here to find out all about it —

Congratulations Bernie, All your years of hard work and determination paid off!

Jodi

Back to School tips for Everyone!

It’s still summer but many students are getting ready to head off to School. Some to preschool and others to university / college in the fall. You may be thinking of what they'll need to bring and some may still be trying to figure out how to pay for it. See below for a few tips on how to save if you're just starting this long road, as well as a few tips to help prepare for packing for the move away to school.

While it's still summer, many students are getting ready to head back to school. Young ones may be going to preschool and others off to university / college. You may be thinking of what they'll need to bring to school or you may be trying to figure out how to pay for it. See below for a few tips on how to save if you're just starting down this road, as well as a few tips to help prepare for packing for the move away to school.

Preparing for Kindergarten

If you’re a parent or a grandparent, here’s a one pager on how a Registered Education Savings Plan (RESP) can take some of the stress out of figuring out how to pay for these expenses.

Back to school tax tip: Understand and use the RESP

https://docmgt.dynamic.ca/documentdownload/getdocument/10917

Also a little article on how to help your little ones with kindergarten anxiety

https://www.coffeecupsandcrayons.com/10-ways-to-ease-kindergarten-anxiety/

Packing for College or University

If you're trying to make a list of things to help you prepare for the move away to university or college, here’s some things to consider bringing with you.

https://www.hercampus.com/life/campus-life/what-bring-college-best-college-packing-list-ever

Wishing you all the best for whichever path you're on!

Jodi

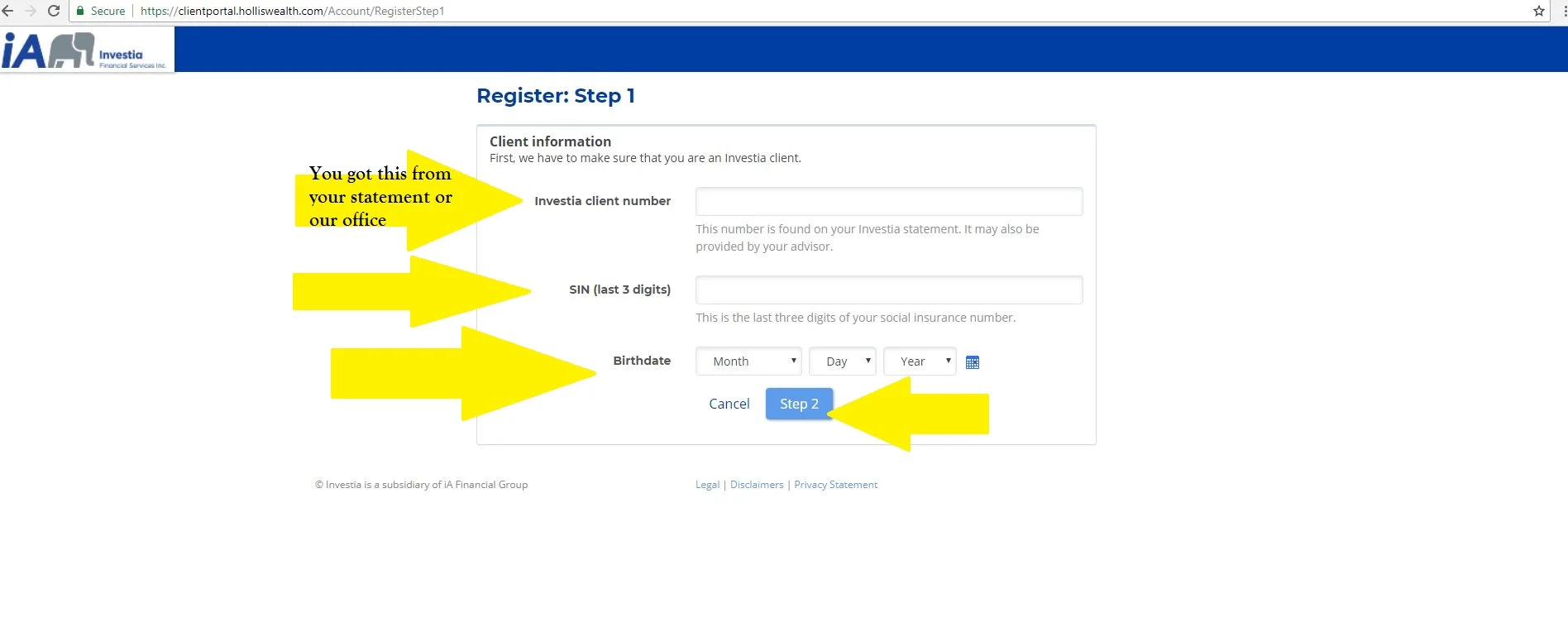

Registering for HollisWealth ONLINE Access TODAY!

Please follow the step by step Tutorial snap shots below to REGISTER FOR ONLINE ACCESS!

We are here to help, and we want to make this process easy for you. Your accounts are view-able online and we want to make sure you can easily access them, and LINK them together if needed. ( For the Linking Option, please continue to the bottom)

...

Please follow the step by step Tutorial snap shots below to REGISTER FOR ONLINE ACCESS!

We are here to help, and we want to make this process easy for you. Your accounts are view-able online and we want to make sure you can easily access them, and LINK them together if needed. ( For the Linking Option, please continue to the bottom)

The Security Questions are there for you to choose from. You may use the same questions for a different registration of yours, but we recommend doing them in a different order.

After that, your DONE!

* If you have any problems, please call for assistance, Michelle and Bonnie will be glad to help!

Family Linking starts HERE!

( See Below for Step by Step Tutorial)

All Done!!

If you require assistance, please call Michelle or Bonnie.

Michelle Currie

What I Own What I Owe

Before you can make any plans for your financial future, you have to figure out where you stand today.

Use this form to help determine your net worth

...

Before you can make any plans for your financial future, you have to figure out where you stand today.

Use this form to help determine your net worth, then sit down with your advisor and plan for tomorrow.

Jodi Dark

Take Control of Debt

Take Control of Debt

A successful four-step formula - reprinted from Fidelity Investments

Over the last decade, Canada has become addicted to debt. According to a March 2004 report issued by Statistics Canada, for every $100 in disposable income, Canadian households owed an average of $102.90 in debt including consumer credit and mortgages. Obviously, owing more than your income is rarely a good way to achieve financial independence. So if you find yourself having difficulty staying ahead of your bills, take heart. There are ways to reduce your debt and take back control of your finances. Here are four simple steps to help get you started.

A successful four-step formula - reprinted from Fidelity Investments

Over the last decade, Canada has become addicted to debt. According to a March 2004 report issued by Statistics Canada, for every $100 in disposable income, Canadian households owed an average of $102.90 in debt including consumer credit and mortgages. Obviously, owing more than your income is rarely a good way to achieve financial independence. So if you find yourself having difficulty staying ahead of your bills, take heart. There are ways to reduce your debt and take back control of your finances. Here are four simple steps to help get you started.

1. Assess your situation

The first step to getting out of debt is to assess your current situation. Answer the following questions for yourself: What debts do I owe? When are they due? At what rate of interest? After you’ve compiled a catalogue of your obligations, ask yourself how much you can reasonably put toward each of those debts each month. Writing this information down will put your situation into perspective, and provide you with a roadmap for regaining control of your finances.

2. Control spending

It’s hard to reduce your debt without setting limits on your spending. Give yourself a specific amount of money to spend each week on essentials as well as miscellaneous expenses. Withdraw this amount in cash at the beginning of the week—do not use credit cards! Once you’ve spent your allowance, you’re done for the week. This “get tough” approach will slowly wean you off of credit.

3. Track your spending

To prevent yourself from sliding into debt again, you must understand how you got into trouble in the first place. You can do this by tracking your expenses for a specific time period—say, one month. Keep a small notepad with you and make a note of every dollar that leaves your wallet. Once you see how you're spending your money, you’ll be in a better position to change spending habits and trim unnecessary expenses

4. Consider a consolidation loan

If your debts are substantial, consider a consolidation loan. By lumping smaller debts into a single, large debt, you can keep better track of your progress. More importantly, consolidation loans are often available at lower rates of interest than credit cards and other loans. That could help you shave months off your payment schedule.

Staying debt-free over the long term

Understand that financial freedom isn’t a one-time event. Rather, it is an ongoing process that requires patience and discipline. In the end, whether you’re successful or not at reducing your debt depends largely on making a lifelong commitment to being responsible with your money.

Jodi Dark

Simplify preparing for Income Tax Time

This time of year we always receive a lot of calls, for missing tax slips, or for those who want to receive their slip early to file their taxes early...............We want to help simplify this process for you.

...........My Account is an easy option to help you! It will allow you to track your refund, view or change your return, check your benefit and credit payments, view your RRSP limit, as well as your TFSA Contribution limit. You can set up direct deposit, receive online mail, and so much more

We would like to help you simplify your time while preparing for taxes this year! Here we have a few things for you to keep in mind.

During this time of year we always receive a lot of calls, for missing tax slips, also clients looking for some of their tax slips early hoping they can file their taxes early.

Here's something to keep in mind. In our Feb 2, 2018 Blog we have a couple lists, as well as the deadline for some tax slips. Note: The deadline for some slips is not until the end of March.

For those of you who would like to simplify life. We suggest registering for My Account an Online site with CRA. This will help to ensure that you have all your investment tax slips as well as any T4's and more, see below for a overview of the options available.

My Account is an easy option to help you! It will allow you to track your refund, view or change your return, check your benefit and credit payments, view your RRSP limit, as well as your TFSA Contribution limit. You can set up direct deposit, receive online mail, and so much more.

If you are registered with My Account, you can also use Auto-fill my return when you file online using certified software.

On your mobile device? Try the MyCRA mobile app - you can securely access key parts of your tax information and manage personal details, wherever you are.

Michelle Currie

WHAT A CERTIFIED FINANCIAL PLANNER CAN DO FOR YOU!

2018 marks my 10th year as a Certified Financial Planner. Although I’ve been in this business for 21 years now, 10 years ago I decided to go the added mile for my clients and myself and take the education to become a certified specialist in financial planning.

2018 marks my 10th year as a Certified Financial Planner. Although I've been in this business for 21 years now, 10 Years ago I decided to go the added mile for my clients and myself and take the education to become a certified specialist in financial planning. It was one of the most challenging periods of my life, taking courses with a young family at home, while being in the office full time, but so worth it.

CFP's follow a strict code of ethics and must maintain many hours of continuing education each year.

To learn more about what a CFP can do for you and what it means to me, please see the following links.

Jodi Dark

As the old saying goes "The only two things in life that are certain are death and taxes"

This is the time of year when we have many calls from clients asking when they can expect their investment receipts.

Below is a timeline what investment slips to look out for and when they are typically mailed out.

This is the time of year when we have many calls from clients asking when they can expect their investment receipts.

Below is a timeline what investment slips to look out for and when they are typically mailed out.

Regulatory deadlines

T4 – February 28th/29th

T5 – February 28th/29th

T3 – March 30th

T5013 – March 31st

NR4 – March 31st

Contribution Receipts – Contributions made in the first 60 days of the year are mailed daily while contributions for the remainder of the year are mailed in January of the following year.

If you own open or non registered investments please keep your year end receipts as your accountant may need these to calculate any capital gains

Also click here for a one pager that lists some of the things you should think about collecting in order to get all of the tax breaks you may be eligible for.

Helpful one page checklist

Happy Calculating!

Jodi Dark

Understanding Mutual Fund MER's

Sometimes Clients have Questions regarding MER's and how they work.

Sometimes Clients have Questions regarding MER's and how they work.