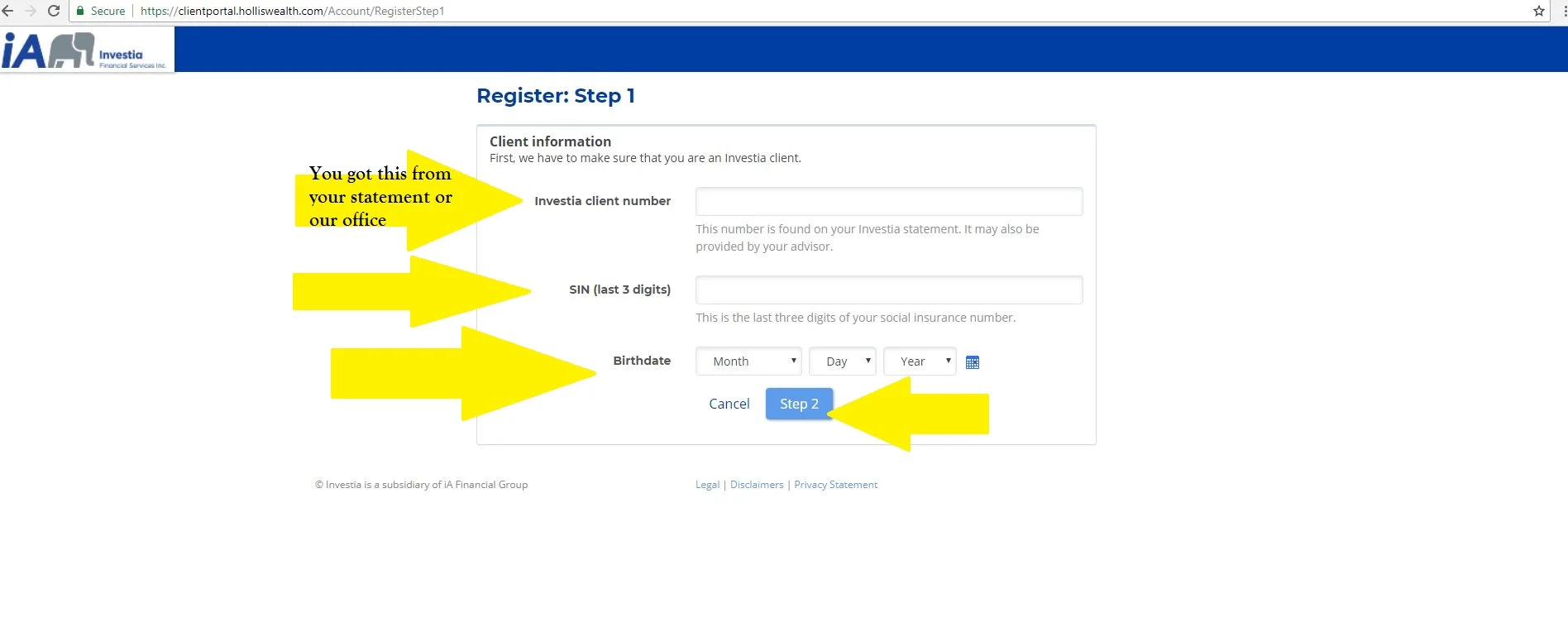

Registering for HollisWealth ONLINE Access TODAY!

Please follow the step by step Tutorial snap shots below to REGISTER FOR ONLINE ACCESS!

We are here to help, and we want to make this process easy for you. Your accounts are view-able online and we want to make sure you can easily access them, and LINK them together if needed. ( For the Linking Option, please continue to the bottom)

...

Please follow the step by step Tutorial snap shots below to REGISTER FOR ONLINE ACCESS!

We are here to help, and we want to make this process easy for you. Your accounts are view-able online and we want to make sure you can easily access them, and LINK them together if needed. ( For the Linking Option, please continue to the bottom)

The Security Questions are there for you to choose from. You may use the same questions for a different registration of yours, but we recommend doing them in a different order.

After that, your DONE!

* If you have any problems, please call for assistance, Michelle and Bonnie will be glad to help!

Family Linking starts HERE!

( See Below for Step by Step Tutorial)

All Done!!

If you require assistance, please call Michelle or Bonnie.

Michelle Currie

The Secret To Happiness Has Nothing To Do With Money

Some people just ooze happiness: They always seem to be smiling and having fun, and let negative emotions and experiences roll off their backs. But if you think there's no way you could possibly ever be that way, you're wrong. Science proves

Some people just ooze happiness: They always seem to be smiling and having fun, and let negative emotions and experiences roll off their backs. But if you think there's no way you could possibly ever be that way, you're wrong. Science proves that you do have the power to change your outlook on life. And it isn't hard, either: Most of the tips that follow are as simple as cracking a smile once in a while (yes, that's one of the tips). Here's to a happier you!

Michelle Currie

What I Own What I Owe

Before you can make any plans for your financial future, you have to figure out where you stand today.

Use this form to help determine your net worth

...

Before you can make any plans for your financial future, you have to figure out where you stand today.

Use this form to help determine your net worth, then sit down with your advisor and plan for tomorrow.

Jodi Dark

Take Control of Debt

Take Control of Debt

A successful four-step formula - reprinted from Fidelity Investments

Over the last decade, Canada has become addicted to debt. According to a March 2004 report issued by Statistics Canada, for every $100 in disposable income, Canadian households owed an average of $102.90 in debt including consumer credit and mortgages. Obviously, owing more than your income is rarely a good way to achieve financial independence. So if you find yourself having difficulty staying ahead of your bills, take heart. There are ways to reduce your debt and take back control of your finances. Here are four simple steps to help get you started.

A successful four-step formula - reprinted from Fidelity Investments

Over the last decade, Canada has become addicted to debt. According to a March 2004 report issued by Statistics Canada, for every $100 in disposable income, Canadian households owed an average of $102.90 in debt including consumer credit and mortgages. Obviously, owing more than your income is rarely a good way to achieve financial independence. So if you find yourself having difficulty staying ahead of your bills, take heart. There are ways to reduce your debt and take back control of your finances. Here are four simple steps to help get you started.

1. Assess your situation

The first step to getting out of debt is to assess your current situation. Answer the following questions for yourself: What debts do I owe? When are they due? At what rate of interest? After you’ve compiled a catalogue of your obligations, ask yourself how much you can reasonably put toward each of those debts each month. Writing this information down will put your situation into perspective, and provide you with a roadmap for regaining control of your finances.

2. Control spending

It’s hard to reduce your debt without setting limits on your spending. Give yourself a specific amount of money to spend each week on essentials as well as miscellaneous expenses. Withdraw this amount in cash at the beginning of the week—do not use credit cards! Once you’ve spent your allowance, you’re done for the week. This “get tough” approach will slowly wean you off of credit.

3. Track your spending

To prevent yourself from sliding into debt again, you must understand how you got into trouble in the first place. You can do this by tracking your expenses for a specific time period—say, one month. Keep a small notepad with you and make a note of every dollar that leaves your wallet. Once you see how you're spending your money, you’ll be in a better position to change spending habits and trim unnecessary expenses

4. Consider a consolidation loan

If your debts are substantial, consider a consolidation loan. By lumping smaller debts into a single, large debt, you can keep better track of your progress. More importantly, consolidation loans are often available at lower rates of interest than credit cards and other loans. That could help you shave months off your payment schedule.

Staying debt-free over the long term

Understand that financial freedom isn’t a one-time event. Rather, it is an ongoing process that requires patience and discipline. In the end, whether you’re successful or not at reducing your debt depends largely on making a lifelong commitment to being responsible with your money.

Jodi Dark

Watch your wallet and eat Healthy with these budget friendly tips in mind.

Wealth means nothing if you don’t have your health, here are some tips for keeping your eating clean.

Buying organic food can be an expensive endeavor. Watch your wallet and eat healthy with these budget friendly tips in mind.

1) Know ‘The Dirty Dozen’ and ‘Clean 15’ (See Below). It isn’t necessary to purchase every single item organic, prioritize your spending on foods you care most about and foods that come highly recommended for buying organic because they have......

Wealth means nothing if you don’t have your health, here are some tips for keeping your eating clean.

Here are some cost saving strategies for buying organic produce. Buying organic food can be an expensive endeavor. Watch your wallet and eat healthy with these budget friendly tips in mind.

1) Know ‘The Dirty Dozen’ and ‘Clean 15’ (See Below). It isn’t necessary to purchase every single item organic, prioritize your spending on foods you care most about and foods that come highly recommended for buying organic because they have the highest level of pesticide residue. The least pesticide covered can be purchased non-organic.

2) Try to buy in season.

3) Planning out your meals ahead of time is a great way to save money and time.

Bonnie McPhail

Simplify preparing for Income Tax Time

This time of year we always receive a lot of calls, for missing tax slips, or for those who want to receive their slip early to file their taxes early...............We want to help simplify this process for you.

...........My Account is an easy option to help you! It will allow you to track your refund, view or change your return, check your benefit and credit payments, view your RRSP limit, as well as your TFSA Contribution limit. You can set up direct deposit, receive online mail, and so much more

We would like to help you simplify your time while preparing for taxes this year! Here we have a few things for you to keep in mind.

During this time of year we always receive a lot of calls, for missing tax slips, also clients looking for some of their tax slips early hoping they can file their taxes early.

Here's something to keep in mind. In our Feb 2, 2018 Blog we have a couple lists, as well as the deadline for some tax slips. Note: The deadline for some slips is not until the end of March.

For those of you who would like to simplify life. We suggest registering for My Account an Online site with CRA. This will help to ensure that you have all your investment tax slips as well as any T4's and more, see below for a overview of the options available.

My Account is an easy option to help you! It will allow you to track your refund, view or change your return, check your benefit and credit payments, view your RRSP limit, as well as your TFSA Contribution limit. You can set up direct deposit, receive online mail, and so much more.

If you are registered with My Account, you can also use Auto-fill my return when you file online using certified software.

On your mobile device? Try the MyCRA mobile app - you can securely access key parts of your tax information and manage personal details, wherever you are.

Michelle Currie

2018 Federal Budget Summary

In order to keep you up to date on the proposed changes in the Federal Budget you may want to click on this document to see how they may affect you.

In order to keep you up to date on the proposed changes in the Federal Budget you may want to click on this document to see how they may affect you.

Click here

Jodi Dark

WHAT A CERTIFIED FINANCIAL PLANNER CAN DO FOR YOU!

2018 marks my 10th year as a Certified Financial Planner. Although I’ve been in this business for 21 years now, 10 years ago I decided to go the added mile for my clients and myself and take the education to become a certified specialist in financial planning.

2018 marks my 10th year as a Certified Financial Planner. Although I've been in this business for 21 years now, 10 Years ago I decided to go the added mile for my clients and myself and take the education to become a certified specialist in financial planning. It was one of the most challenging periods of my life, taking courses with a young family at home, while being in the office full time, but so worth it.

CFP's follow a strict code of ethics and must maintain many hours of continuing education each year.

To learn more about what a CFP can do for you and what it means to me, please see the following links.

Jodi Dark

A comment on the recent -Market Correction -

A comment on current market volatility from Fidelity’s Jurrien Timmer Director of Global Macro for Fidelity Management & Research Company

“Whether last week's correction ended on Friday or continues for days or weeks to come is of course unknowable. My guess is that the market chops around for a while, perhaps several months, as typically happens after the economy reaches a momentum peak. For the typical investor, it's worth remembering that part of the value

A comment on current market volatility from Fidelity’s Jurrien Timmer Director of Global Macro for Fidelity Management & Research Company

“Whether last week's correction ended on Friday or continues for days or weeks to come is of course unknowable. My guess is that the market chops around for a while, perhaps several months, as typically happens after the economy reaches a momentum peak. For the typical investor, it's worth remembering that part of the value of the stock market is that over the long run, equities generate better returns than less risky investments (like money market funds or bonds) but that the "cost" of those higher returns is higher volatility. In that respect, nobody should view the 52% return for the S&P 500 over the last 2 years—amid record low vol—as normal.

So I for one am not concerned that the stock market is starting to behave like its normal self again. And for investors with an appropriate investment plan based on their risk tolerance, goals, financial situation, and timeline, short-term volatility shouldn't require any action. More active investors may actually welcome this volatility. I myself am relieved actually. Better a correction now than a bear market later.

Corrections are like vegetables in that sense. They don't always taste good, but they can be good for you.”

Jodi Dark

As the old saying goes "The only two things in life that are certain are death and taxes"

This is the time of year when we have many calls from clients asking when they can expect their investment receipts.

Below is a timeline what investment slips to look out for and when they are typically mailed out.

This is the time of year when we have many calls from clients asking when they can expect their investment receipts.

Below is a timeline what investment slips to look out for and when they are typically mailed out.

Regulatory deadlines

T4 – February 28th/29th

T5 – February 28th/29th

T3 – March 30th

T5013 – March 31st

NR4 – March 31st

Contribution Receipts – Contributions made in the first 60 days of the year are mailed daily while contributions for the remainder of the year are mailed in January of the following year.

If you own open or non registered investments please keep your year end receipts as your accountant may need these to calculate any capital gains

Also click here for a one pager that lists some of the things you should think about collecting in order to get all of the tax breaks you may be eligible for.

Helpful one page checklist

Happy Calculating!

Jodi Dark

New Year Resolutions

Regardless if your New Year’s Resolution was to exercise more, eat healthier or improve your savings plan… give yourself some time. It takes 21 days to form a habit! Stick with it to reap the rewards😊.

Regardless if your New Year’s Resolution was to exercise more, eat healthier or improve your savings plan… give yourself some time. It takes 21 days to form a habit! Stick with it to reap the rewards😊

Bonnie McPhail

Happy New Year!

Hello and Happy 2018 Everyone!

Over the Christmas Holidays we enjoyed yummy food, even if it was a little too much ! it was worth it.

We enjoyed great company, being surrounded by family and friends.

We were blessed with a white Christmas, my favorite kind!

Hello and Happy 2018 Everyone!

Over the Christmas Holidays we enjoyed yummy food, even if it was a little too much ! it was worth it.

We enjoyed great company, being surrounded by family and friends.

We were blessed with a white Christmas, my favorite kind!

Having all this snow gave us an Idea. Lets go tubing on a pizza! This is my son Dawson, sliding down the hill on a Pizza Tube. We are at my husbands Grandparents home in Corunna, Ontario.

What you can see in this picture is Happiness! This activity gives children from all ages so much enjoyment. Good for ages 0 to 39 yrs old .....no one is too old!

You can participate, you can watch, you can cheer...it brings you so much Joy and Happiness to see.

What you can't see is the freezing cold temperature as the wind whips down the hill. You can't see the line up of cousins to try this out next. You can't hear the kids screaming in joy and laughing with excitement. You can't see most parents inside cheering on the kids with warmth of family from inside the house ( me included). You can't see that at the bottom of the hill was the St. Clair River flowing with Ice!!! My husband David piled snow to slow the kids down near the bottom. We had a few parent supervisors as an extra wall to make sure that no one went swimming while snow tubing. It was a success, everyone had a fantastic time, and no one went for a swim.

I hope that you all enjoy this Fresh start to the New Year. Keep safe and stay warm, I do encourage you to venture out on occasion to enjoy some fun in the snow!

-Happiness is the New Rich-

Michelle

Credit for this photo goes to my Aunt Jennifer Matthews-Jameson

Tis The Christmas Season!

Merry Christmas

Our Annual Office Christmas Pot Luck and Games.

Oh what fun we had!! We wore our Ugly Christmas attire and enjoyed great company with good food. Afterwards we played some fun games including Michelle's annual Amazing race/ Scavenger hunt which kept us moving and helped work off all the yummy food.

We would like to wish you a Happy Holiday Season. We hope you enjoy some good food with family and get some time to relax.

Merry Christmas from Jodi, Bonnie and Michelle

Client Appreciation Shred Day

This Year we offered a Shredding service as a Client Appreciation THANK YOU to our clients!

This year we offered a shredding service as a Client Appreciaton. THANK YOU to all our clients who brought in their shredding, we may have to do this again next year!

Michelle Currie

Look What's New!

Welcome to our brand new website! We're excited to bring you our new look - it's a time for new beginnings.

Welcome to our brand new website! We're excited to bring you our new look - it's a time for new beginnings.

Stay for a while, have a peek around and let us know what you think. There's all the stuff that you would expect, and a few new things (like this blog!), so come spend some time on our pages.

We had a great time working with Bemoved Media who came all the way from Vancouver, BC, to make us look good! We think they captured our investment beliefs and style perfectly and combined with their photography, confirmed that we do indeed live in a beautiful community.

Special thanks as well to some of our clients who came out to share in the fun (as well as a few mimosas). We appreciate you!

Jodi Dark