A Word from Our Partners

With everything that is happening in the world, now is a good time to step back and think about where we are and where we might be going. There is a tremendous amount of information available. But what’s missing is a framework for that information that would help clarify the big picture. ..

How To Think About The Corona virus Pandemic: The Big Picture

March 17, 2020 • Brad McMillan

With everything that is happening in the world, now is a good time to step back and think about where we are and where we might be going. There is a tremendous amount of information available. But what’s missing is a framework for that information that would help clarify the big picture.

What I want to do today is outline how I see that big picture, which will hopefully provide a framework to understand where we are headed. In the next couple of days, I plan to go into more detail on the individual components.

Breaking Down The News

First, we have to break down the news. There are three different issues that we need to consider, and the news often conflates them. The issues are (1) the virus itself and the pandemic, (2) the economic impact of the pandemic, and (3) the financial market implications of that impact. By considering them individually, we can gain some clarity.

The virus itself.

The base question is whether the virus is controllable or not. And the answer is yes. In the absence of restraints, the virus will spread—as we saw in China, in Italy and in the U.S. But when proper restrictions are put into place, it can be brought under control. This idea has been proven in China and South Korea, and Italy is now reportedly stabilizing. Here in the U.S., we understand what has to be done, and we are now doing it. This is the end of the beginning.

Unfortunately, we are not out of the woods just yet. Everyone now knows what to do and why, as well as what the stakes are. If we just stay home, things will eventually get better. But there is usually a lag of about two weeks between the time that restrictions are put into place and when new cases stabilize. So, we can expect the news here to get worse for a while. We are likely past the point of maximum danger, but we are not past the point of maximum impact. Even as the rate of spread slows, expanded testing will make it look like things are getting worse. Expect to see that story in the headlines.

The economic impact.

The economic damage is certainly real. But going forward, the question is whether the next year will look like it did after 9/11—or like 2008.

Right now, the resemblance to 9/11 is much greater. The pandemic is an outside shock to the economy, which has generated fear and will slow consumer and business spending, much like 9/11. As such, like 9/11, the economic impact could pass once the fear does. That is the base case: real damage, but then a recovery as confidence returns. The economic impact will, however, likely be worse than after 9/11. The slowdown in spending is very likely to be worse and longer lasting this time, which could (over time) turn the 9/11 into another 2008.

This scenario is something we must keep in mind, but whether it happens will depend on whether government policy is sufficiently supportive to both workers and businesses affected by the drop in demand. Here, the news is good. The Fed acted fast and hard to provide monetary stimulus. Unlike 2008, the Fed has clearly stated it will do what it needs to do in order to avoid a crisis. The federal government is also in the process of responding with economic support. While that process is not yet complete, signs are that any necessary support will be available, minimizing the chances of another 2008. There will be economic damage, but with proper policy support, it is likely to be limited.

Financial market implications. Finally, when we look at the markets, we see a clear expectation that the pandemic will continue and that the economic damage will be substantial. While that still may end up being the case, policy actions both here and around the world have made that substantially less likely in the past week. Signs are that the pandemic will be brought under control and that the economy will get enough support to weather the storm. Make no mistake, there will be damage. But from a market perspective, the question will be whether the damage is greater than markets now expect, or less. Signs are that the damage will be less, which should support markets going forward and eventually enable a recovery.

What Happens Next? The crisis is not over. We can certainly expect the headlines to keep screaming and even get worse over the next couple of weeks, which could keep markets turbulent. We know, however, what is needed to solve the problem and that those measures are largely in place. By keeping the framework discussed here in mind, we will be prepared for those headlines and able to see the gradual improvement underneath them.

This is a difficult time for everyone, and worries are surging. Although those worries have allowed for the necessary policy changes to solve the problem, worry is always difficult. As we move forward, keep in mind that while the concerns are real, so is the policy progress. In the not-too-distant future, we are likely to see the virus brought under control here just as we have seen in other countries. Keep calm and carry on.

Brad McMillan is the chief investment officer at Commonwealth Financial Network.

Office Updates concerning the Coronavirus

Office Services during the COVID-19 virus

Office Protocol at this time

We hope that you are healthy and at home safe and sound!

We want to let you know that we continue to monitor the updates of the ever changing news on the Covid 19 virus and of course market conditions.

Currently we are in the office and available for phone consultations and to answer any concerns you may have.

We do however share office space with another company who is practicing strict protocol with all of their clients and staff. Therefore the front doors to our office are locked, however we are still here.

We are requesting that instead of dropping by the office that you call us to set up a phone appointment and if you absolutely need to visit the office to pick up or drop off any items, then please let us know ahead of time so we are able to meet you at the door.

For now we are working out of our building however there may come a time when the government tells us this is no longer an option.

We want to let you know that we have all capabilities of working from home and that digital signing will be available.

We have access to all of our systems and will continue to be able to service your needs, even if it is at a distance.

We hope that you stay happy and healthy!

Please reach out if you have any questions or concerns.

Also please follow us below on social media to keep informed of any updates.

Thank You

Jodi, Michelle and Bonnie

Golden Slumber

How to get the right amount of shut-eye even with a hectic schedule.

Life always seems to busy! The big question is, Does your schedule allow enough time for a good night’s sleep? All too often sleep gets put on the back burner in favour of finishing household tasks or preparing for tomorrow’s important presentation. In fact, a report by Statistics Canada found that one-third of Canadians sleep less than the recommended seven to nine hours a night. When we don’t get enough shut-eye we can get irritable, stressed and more prone to getting sick. What’s more, it’s estimated that a lack of sleep costs Canadian businesses about $21 billion a year in lost productivity.

A restful sleep each night can help you feel healthier, happier and more productive. Here are some tips to get snoozing.

Schedule it

A good night’s sleep should be high on your priority list, so if it helps, why not include it in your daily schedule? Block off seven to nine hours during the same time slot each night – even on weekends. Keeping your biological clock on a regular schedule can help ensure the sleep you get is restful.

Create a pre-bed ritual

If you have trouble winding down after a hectic day, try some calming pre-bedtime activities such as a bath, reading, meditation or writing in a journal. The goal is to train your mind and body that it’s time to settle down for the night.

Lights out

Darkness triggers production of melatonin, the sleep-inducing hormone, and too much ambient light – including the blue light from a smartphone or tablet – can suppress it. The darker your bedroom, the more likely you are to sleep well. Consider installing blackout curtains to block streetlights and removing electronics with light up displays. If you like to read e-books before nodding off, try using a reader that isn’t backlit, or a screen cover that minimizes blue light from the device.

Take the pressure off

Poor sleep is our number-one response to stress. And it’s a double-edged sword — not getting enough shut-eye increases stress. So how do you break the cycle? Find ways to recharge throughout the day. Take ten minutes to go for a walk, practise mindfulness exercises, try yoga or download a deep-breathing app.

Stay cool

Our body temperature naturally drops as we’re falling asleep, so a cool room can help that process along. An environment that’s too warm may inhibit drifting off. Ideal bedroom temperatures range from 18 to 22°C (65 to 72°F) – experiment to see what works best for you.

Get moving

People who exercise regularly tend to sleep better. Working out three or four times a week can make a real difference over time. But be careful not to hit the gym too close to bedtime – the adrenalin from your workout could end up keeping you awake.

Eat to sleep

Did you know that certain foods can help you nod off at night? Your body needs vitamin B6 to make melatonin, so eating B6-rich foods like fish, bananas, chickpeas, nuts and lentils can help. Other foods such as walnuts, some dairy products and turkey contain tryptophan, a sleep enhancing amino acid that helps your body make serotonin and melatonin.

Avoid alcohol

It’s no surprise that cutting back on caffeine can reduce wakefulness. But did you know that alcohol inhibits sleep, too? Yes, that glass of wine may help you drift off, but as its effects wear off, you’re more likely to wake up You may want to avoid overhydrating before bed, too – it will mean fewer trips to the bathroom.

If you frequently have trouble falling asleep, you may want to talk to your doctor to rule out sleep apnea or any other underlying causes. It’s also a good idea to get the go-ahead from your doctor to ensure these strategies are right for you.

https://mysolutionsonline.ca/fall-2019/golden-slumber

Bonnie

MARKET VOLATILITY

It’s hard not to panic when the stock market is moving like a roller coaster!

However pulling your money out may actually mean missing growth opportunities, which could also mean missing out on your investment objectives. Historically………

It’s hard not to panic when the stock market is moving like a roller coaster!

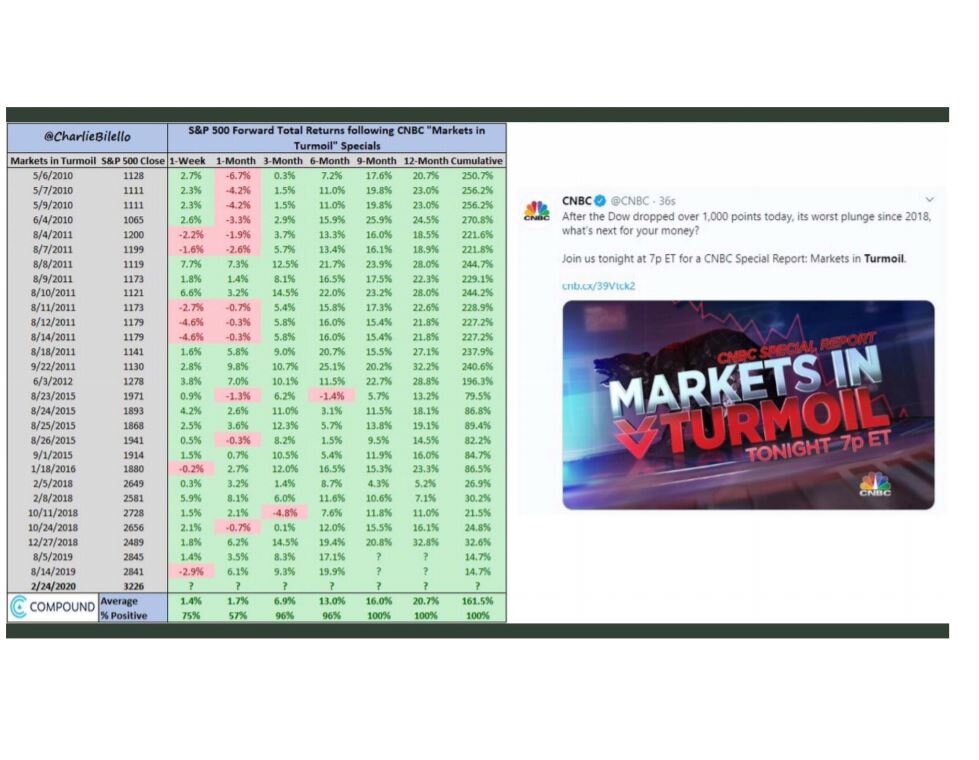

However, pulling your money out may actually mean missing growth opportunities, which could also mean missing out on your investment objectives. Historically when things appear to be at their worst, it is typically the best time to invest because these downturns have been followed by major market upturns.

When your instinct is to move everything to cash here are some things to consider:

Have my goals changed?

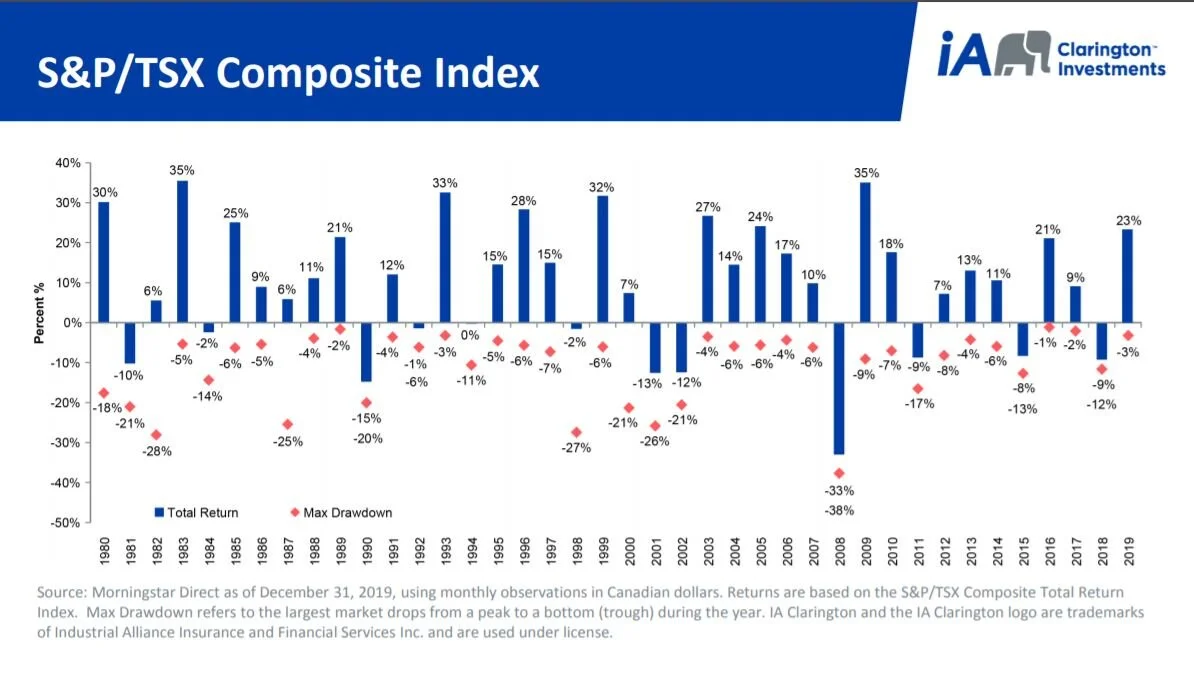

If nothing material has changed in your life and you’re not going to use the funds from your investment for a few years, then as the graph below shows, you are better to ride out the volatility then move to cash and try to time your way back into the market. Most people’s gut prevents them from buying in at the right time.

Is my portfolio diversified?

You should know what you are holding in your portfolio so you can see if your mix of cash, bond and stock is still right for your time horizon, as well as your tolerance for risk! It’s a good idea to review this at least once every year.

Do I know the quality of the stock in my portfolio?

The quality stock you hold in your portfolio is important. In times of uncertainty even blue-chip stocks get caught up in the hysteria. However, if you remember that the stock you are holding is a reflection of actual companies with employees that go to work each day, it may help to ease your nerves. If these companies that you are holding are high quality and will not likely go bankrupt then you can rest assured that the stock price will go back up once the market uncertainty is over.

Should I flip my thinking?

Often when markets are in a downward spiral our gut reaction can be to protect and want to sell because things feel uncomfortable. Think about flipping your thinking. Is this actually a good time to buy while the market is “on sale”? Is the investment you were willing to buy a few months ago down in price and is it a better value now then it was then? It may be a great time to get a bargain.

Am I losing sleep at night?

This is gut check time. If you are actually a nervous wreck and worrying is consuming all of your time, you may need to consider if the stress is worth it. If this is you, take the opportunity to talk to your advisor to see what makes sense for your stress level and for the good of your health.

-Jodi

Source: Morningstar Direct as at September 30, 2018. For illustration purposes only. Performance histories are not indicative of future performance. The index is unmanaged and cannot be purchased directly by investors. Periods of market crises highlighted on the chart above are not representative of Morningstar Direct.

Need some quotes to keep you grounded?

“Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas.”

– Paul Samuelson, economist, professor and bestselling author

“An investment portfolio is like a bar of soap: the more you touch it, the smaller it gets.”

– Investment adage

“In the old legend the wise men finally boiled down the history of mortal affairs into the single phrase – This too will pass.”

– Benjamin Graham, investor, economist and professor

Creating a Bucket list for the year - Dream Big- You're Worth it!

I am generally a list person. However, studies have shown that when you create a vision board you can then visualize the goals and dreams you have. This helps you focus………

I am generally a list person. However, studies have shown that when you create a vision board you can then visualize the goals and dreams you have. This helps you focus on them. Each day you can see the images of what your working towards, along with the words that will help motivate you towards them.

Here are some quotes to inspire you to Dream Big and set Goals:

“ It is said that if you aim at nothing you will hit it every time”- Zig Ziglar

“ Anything you can imagine you can create”- Oprah

What is a vision board?

It is a collage of images and/or phrases that mean something to you. The images on your board can be photos of what you want, where you want to be, who you want to be with. Anything that will help to motivate you. For example, if you want to live in Hawaii, find photos of Hawaii, the beaches, the sunsets, palm trees and scenery. If you want to be a doctor, find photos of a doctor. Also add in a few motivational quotes. Do whatever works for you, its your masterpiece!

Your vision board can be images cut out from magazines on a piece of poster board or a digital graphic you keep on your phone. Place your vision board somewhere you will see it everyday. Your closet, the bathroom mirror, sometimes it’s a good idea to take a picture of your finished board, and then you can look at it anywhere you are😊

Have Fun Doing it!!!! If you have kids of any age encourage them to do this with you. It is something to help them dream big and teaches them to set goals.

Here are a few fun ways to get started, of course there are tons of ideas on Pinterest.

To help you get started here are a few Templates.

For an Easy One-page Vision Board Template for Adults or Kids Click HERE

Another Free Vision Board Template

Once you start with these, you can add pictures, words etc to make your vision board your own.

Remember Have Fun and Dream Big!

-Michelle

Travelling out of Country this Year: Here are the changes to OHIP that you need to be aware of:

Starting January 2020 the Ontario government’s OHIP coverage for some types of out of country medical costs has changed or been eliminated. While the previous emergency coverage was

Starting January 2020 the Ontario government’s OHIP coverage for some types of out of country medical costs has changed or been eliminated. While the previous emergency coverage was minimal - a maximum of $400 per day, this coverage has now been eliminated. It will now be the travellers sole responsibility to cover any medical costs associated with out of country treatments while travelling. Keep in mind the past coverage of $400/day would not typically have covered the cost of a trip to the emergency room in the US which averaged at a cost of over 2,000/ visit.

If you will be travelling it is important to research and get private coverage NOW more than ever.

First you should explore any existing coverage that you may already have. This coverage could be through an employer sponsored extended health care plan, a program offered through your credit card or any private coverage that you may already have or that is available to purchase.

All programs differ in coverage and in cost so it is important to read the fine print to see which one best applies to you and your family. Don’t forget that some policies will not cover you for what they may determine as “risky behaviors”, such as bungee jumping or scuba diving.

It is also very important to be totally honest when applying for private coverage. Depending on your age you may be asked health questions which will help determine the cost of your coverage. Obviously the better health you are in the lower the cost will be. Please note that in case of a claim, the insuring company WILL check back on your medical records to make sure you did not have a pre-existing condition that was related to your emergency while travelling and they WILL deny your coverage.

Most companies will also state that you need to call their 1-800 number BEFORE you seek any treatment or they may not cover your costs.

To make it easy for our clients to obtain a quote for travel insurance we offer a link on our website to the Manulife travel insurance HERE.

We encourage you to shop around as this coverage may not be the best plan available for you and your family. It’s important to read the fine print. We encourage you to look at all of your options!

Below we have included links to a summary of the changes published by the Globe and Mail and also a link to the OHIP website for further research.

Click Here to see in the link from the Globe and Mail

Click Here to see the link from Ontario Government OHIP

-Jodi

January 26th-National Spouses Day

January 26th is National Spouses Day

National Spouses Day is observed annually on January 26.

Dedicated to recognizing spouses everywhere, National Spouses Day reminds us to take time for our mate. From being thankful for fulfillment and security of a long-term relationship to the boost of morale and well-being provided by spouses, there are many reasons to celebrate. This day is a time to show your spouse that you care and appreciate all of the things that he or she does for you and the home.

Life gets busy, and we can often take for granted how our spouse improves our life. Pay a heartfelt thank you or compliment to the love of your life. National Spouses Day is a non-gift giving day, so spend time together and reconnect. Don’t forget to say, “I love you.”

HOW TO OBSERVE

If it has been a while since you have expressed appreciation to the partner you walk beside, now is your chance. Again, this day is not about giving gifts but spending time together, enjoying each other and appreciating each other. Use #NationalSpousesDay to post on social media.

Bonnie

20 Year Trends Retrospective

Looking Back

Sometimes when the world feels like it's going a little crazy, it's good to look back and see how far we've come…..

Looking Back

Sometimes when the world feels like it's going a little crazy, it's good to look back and see how far we've come and what we have walked through.

This is a good example of how historic events have affected markets and how they march on despite it.

-Jodi

Tax Free Savings Accounts - 2020 Contribution Limit and more

The TFSA new contribution limit for 2020 is $6,000, this is the same amount set for 2019.

Do you want to start a TFSA? Have your taken withdrawals from your TFSA?

What is the age I can start a TFSA? Breakdown of the TFSA Annual Dollar Limits by Year

What is the 2020 TFSA Contribution Limit?

The TFSA new contribution limit for 2020 is $6,000, this is the same amount set for 2019.

Do you want to start a TFSA?

If you don’t have a TFSA yet then total contribution room available in 2020 for someone who has never contributed and has been eligible for the TFSA since its introduction in 2009 is $69,500.

Have you taken withdrawals from your TFSA?

For those clients who have withdrawn from their TFSA and want to know what their limit is now. One thing to keep in mind is the crystallized gains and losses from the withdrawal(s) are factored in to their TFSA room.

Here’s the formula:

Unused TFSA contribution room to date + total withdrawal made in this year + next year’s TFSA dollar limit = TFSA contribution room at the beginning of next year

( Click here to see CRA rules on making or replacing withdrawals)

What is the age I can start a TFSA?

Anyone 18 or older who has a valid social insurance number is eligible to open a TFSA. Contribution room accumulates beginning in the year in which a person turns 18.

Breakdown of the TFSA Annual Dollar Limits by Year

For 2009, 2010, 2011 and 2012: $5,000

For 2013 and 2014: $5,500

For 2015: $10,000

For 2016, 2017, and 2018: $5,500

For 2019 and 2020: $6,000

Total: $69,500

For Information on

TAX FREE SAVINGS ACCOUNTS- ARE THEY TAXABLE UPON DEATH? WHO SHOULD I NAME AS A BENEFICIARY? Click here to review our recent Blog

-Michelle

Learn to save a life

Cardiac arrest can strike anytime, without warning. By acting fast you could save a life.

Our office just completed a Heart and Stroke CPR course!

If you’re still cooking up your resolutions for the new year, we have a humble suggestion for you: add CPR training to your list. CPR helps keep blood and oxygen flowing and dramatically increases the chances of survival in those who suffer a cardiac arrest.

The Life You Save May Be That of a Loved One.

Did you know that four out of five cardiac arrests occur at home? Not only that, but many victims of sudden cardiac arrest appear healthy and may not have any known heart diseases or risk factors. Performing CPR promptly may save the life of someone you love.

Prevent Brain Death

Brain death occurs four to six minutes after the heart stops breathing. CPR effectively keeps blood flowing and provides oxygen to the brain and other vital organs, giving the victim a better chance for full recovery. Everyday Health reports that If CPR is given within the first two minutes of cardiac arrest, the chances of survival double.

CPR Makes You Smarter

Let’s face it, by the time you complete CPR training, you’ll know something that you didn’t know before you started!

You’ll Feel Confident in the Event of A Cardiac Emergency

By nature, CPR classes are hands-on and interactive. While there may be some online training involved, course participants will learn how to properly execute chest compressions in a fun and supportive environment.

You’ll Test Your Musical Knowledge

The tempo at which you should give chest compressions lines up nicely with popular musical gems such as the Bee Gees’ “Stayin’ Alive,” “Walk Like an Egyptian” by the Bangles, and “Save a Horse (Ride a Cowboy)” by country duo Big and Rich.

Join the 3 Percent

“Although evidence indicates that bystander CPR and AED use can significantly improve survival and outcomes from cardiac arrest, each year less than 3% of the.population receives CPR training, leaving many bystanders unprepared to respond to cardiac arrest.” Become a part of the solution and sign up for a CPR training course today.

Bonnie

Tax Free Savings accounts- Are they taxable upon death? Who should I name as a Beneficiary?

With regards to your (TFSA) Tax-Free Savings Account should you leave that to your spouse?

From an estate planning perspective to name your spouse as ‘beneficiary.’ This may not be the best strategy for you. And here’s why.

What’s the best option when it comes to naming a spouse as a beneficiary on your (TFSA) Tax Free Savings Account assets?

Should you leave your (TFSA) to your spouse / common-law partner, Children or someone else?

If you name your spouse as a beneficiary on a (TFSA) you have two options:

1) Name your spouse / common-law partner as a successor annuitant

or

2) Name your spouse / common-law partner as a beneficiary.

I know it sounds the same, but there is a subtle difference. In Ontario you’re allowed to name a regular beneficiary and / or a successor annuitant.

Successor Annuitant Designation

If you name your spouse as the successor annuitant, upon your death they become the new holder and the tax-exempt status of the TFSA is maintained. All of this is done without affecting any of their TFSA contribution room this makes it clean, simple, and seamless. Yes, you read that correctly, they can have maxed out their own TFSA and still transfer your entire TFSA to their plan.

Also by naming your spouse as a successor annuitant means that you avoid probate fees since these assets will pass outside your estate and directly to your spouse / common-law partner. This is usually the best option if you have a spouse.

Beneficiary Designation

When you choose to name your spouse as a regular beneficiary it is a little more complicated. The TFSA assets still passes outside your estate to your spouse on a tax-free basis, but things aren’t quite as straightforward.

Your spouse can transfer the TFSA upon death to their own TFSA, as long as this occurs during the ‘rollover period’. This rollover period ends on December 31st the following year. Transfers during this period are ‘exempt ‘ and again will not affect your spouses TFSA contribution room.

Note: the transfer amount can only be equal to the fair market value of your TFSA at the date of your death. This rule also applies when you’re transferring to a Non-Spouse (such as your child or friend). Any growth on the assets after your death will be taxable. To avoid unwanted taxes we suggest to make this transfer as quickly as possible.

When transferred to a spouse they will be required to complete an extra step .They will need to declare the contribution, so it may be exempt eating up their own contribution room. They will need to send the CRA (Canada Revenue Agency) form RC240, Designation of an Exempt Contribution Tax-free Savings Account (TFSA) within 30 days of the contribution to their own TFSA to ensure that the contribution does not affect their own TFSA contribution room.

Designation of a (non-spouse) Beneficiary - Child or friend

The TFSA assets still pass outside your estate to your selected beneficiary on a tax-exempt basis except the same rules apply as above. The growth is taxable, the transfer is not as easy but is simple.

The beneficiary would receive your TFSA in cash. They can then add the money to their existing TFSA, as long as they have the contribution room ( see below for a chart of the limits over the years), or they can open one if they do not already have an existing plan. As mentioned above the rules still states that any growth on the assets after the date of death will be taxable. To avoid unwanted taxes it is always best to make this transaction as quickly as possible to limit as much growth as possible.

So in Summary—What is the best strategy when it comes to selecting your spouse to inherit your TFSA assets?

We suggest you consider designating your spouse as successor annuitant.

If you’re like most people, you may not remember whether you designated a beneficiary or successor annuitant or both when you set up your TFSA originally. If you opened your account back when they started in 2009, you really may not recall.

There’s no harm in double checking with your financial advisor. It’s easy to make any necessary changes if they are needed. If your just getting started, now you know which beneficiary to choose.

Here is a breakdown of the two designation types in a chart:

Here is a list of Contribution amounts since 2009 (last updated, January 2019)

What’s the easiest way to save for a down payment on a home?

What’s your mortgage payment going to be?

Lets’ say it’s 1,7500/month for a 350,000 house. Start saving ……

Part Two- How do I save for a down payment on a home?

Here’s my suggestion – What’s your mortgage payment going to be?

Lets’ say it’s 1,7500/month for a 350,000 house. Start saving that amount every month NOW. You’ll be able to see if you can really afford the mortgage payment. You see the bank would love to lend you more money to buy that bigger house because they make more money by doing that. To them it’s just a formula on a paper. But can you afford it and live in your current comfy way?? Everyone has a different lifestyle however we all know someone who is house poor and that is NO fun at all. I’ve seen good marriages fail because there was no fun being had due to a huge mortgage payment. What’s worse it’s over many years – hard to see that light at the end of the tunnel. What use is that big house if there’s no one to share it with??

If you start saving that monthly mortgage payment now and keep doing it each and every month, with no exceptions (because the bank won’t let you away with not paying it each month). Then in less then 2 years you’ll have a 10% down payment. Save for just over 3 years and you’ll have a 20% down payment.

If your income won’t support the whole mortgage payment because you’re currently paying rent then save the difference between what your new mortgage payment would be and what your current rent is.

Using the above example and say your rent is 800/ month..1,750 – 800 = 950. Pay your rent each month but also save $950 each and every month for your down payment. You will have close to 5% down in 18 months and in 3 years you’ll have over 10% down.

Remember you can’t take a month off if you’re going to Cancun because the bank wouldn’t let you away with that. You can’t let yourself away with that either.

Smart money means being disciplined even though it’s hard sometimes.

More importantly you’ll know how it feels to be tied into your mortgage payment so you’ll know if your dream home can comfortably fit into your lifestyle plan.

-Jodi

Bonnie-Part of our Team

Hi I’m Bonnie,

I am the newest member of the Financial by Design team, and I do love working with these ladies:)

Famous 5 Foundation

THE FAMOUS 5 FOUNDATION MANIFESTO

We know today’s privileges are the results of yesterday’s efforts, and we want the whole story—

We are curiou5.

We are the new leaders and future leaders, and we’re here to shape our nation……

Recently we attended one of Famous 5 Foundations speaker series events sponsored by Enbridge here in Sarnia. We learned all about the foundation and found it quite interesting.

THE FAMOUS 5 FOUNDATION MANIFESTO

We know today’s privileges are the results of yesterday’s efforts, and we want the whole story—

We are curiou5.

We are the new leaders and future leaders, and we’re here to shape our nation—

We are ambitiou5.

We have the spirit of discovery, and the desire to explore our great country and beyond—

We are adventurou5.

We are leaders in science, art, politics, education, healthcare; masters of our crafts—

We are ingeniou5.

We are prepared for acts of high and splendid bravery for progress and equality—

We are courageou5.

We are famou5.

The Famous 5 Foundation was founded by 5 amazing women.

Emily Murphy- 1868, Cookstown, ON – 1933, Edmonton, AB

A prominent suffragist, reformer and writer, Emily Murphy (born Emily Gowan Ferguson) became the first female magistrate in the British Empire in 1916

Nellie McClung -1868, Frankville, ON – 1931, Claresholm, AB

Louise McKinney (born Louise Crummy) was a lifelong organizer and staunch supporter of the Women's Christian Temperance Union (WCTU).

Henrietta Muir Edwards-1873, Chatsworth, ON – 1951, Victoria, BC

Nellie McClung (born Nellie Letitia Mooney) was a novelist, reformer, journalist, and suffragist. Feisty and charismatic, Nellie had a way of winning over opponents with her wit and humour.

Louise McKinney- 1849, Montreal, QC – 1931, Fort MacLeod, AB

The eldest of the Famous Five, Henrietta Muir Edwards (born Henrietta Louise Muir), was an artist as well as a legal expert.

Irene Parlby-1868, London, England – 1965, Red Deer, AB

An aristocratic English woman who became a Western Canadian farmer’s wife, Irene Parlby (born Mary Irene Marryat) was a firm advocate for rural farm women of Alberta. She organized and became the first President of the United Farm Women’s Association in 1916.

There are lots of ways this foundation offers knowledge and encouragement.

1) The Speaker Series

The Famous 5 Foundation chooses speakers to talk about their careers, and the passion, vision and determination that drives them toward their goals.

In relating their lives, women and men will hear about the different challenges as well as triumphs; humorous incidents and stories of loss; humbling moments of reflection and inspiring calls to action.

Watch for this speaker series to start up again next year.

2) Legacy

Through educational curriculum’s and projects, the Legacy Programs work to ensure the story of the Famous Five is told and celebrated.

3) Future 5

Through skill-building workshops and events, the Future 5 Program helps young girls grow into Canada’s next generation of leaders.

The speaker we were privileged to watch that day was Jennifer Buchanan. She is just one of the extraordinarily successful women whom they have had present on their stage. Jennifer is a health speaker, health entrepreneur and a certified music therapist. She shared her story along with the struggles she went through as a female entrepreneur starting her own business. She told us about her vision, and the passion she had for it, as well as the fear that sometimes prevents us from moving forward with our dreams. We also learned about the importance music can have on our lives, she shared a short video where we watched how music therapy can be used to help patients with Dementia, as well as its affects for differently abled persons. It was very touching and a great reminder.

Do I Really Need an Emergency Fund?

The first question you need to ask is do I have debt? Not mortgage debt or a huge line of credit but the other debt. The bad debt…

Part One- FOR ANYONE WITH CREDIT CARD DEBIT

YES, YES, Yes you do! However, your personal situation will determine how big your emergency fund should be.

The first question you need to ask is do I have debt? Not mortgage debt or a huge line of credit but the other debt. The bad debt…you know credit cards, store credit cards, those things with an absurdly high interest rate. If you have that kind of debt, then you NEED to start an emergency fund right away.

Don’t worry about paying off those credit cards first. Instead get started right away and save or sell some things to get $1,000 quick. If you can’t save with your current income then you need a side hustle or you need to pick up some extra shifts, maybe work some overtime, is there a bonus coming – use that (you didn’t really need that new furniture or the trip to Mexico). You see you need to pay off that bad debt soon, but first you need some safety in your life. You need to get together $1,000 for emergencies and put it either in a cash account (not attached to your debit card) or literally in cash somewhere in your house. Somewhere where you can’t easily spend it, because needing a pizza on Friday night, is not an emergency. I’m tired and don’t feel like cooking, is not an emergency! Christmas and birthdays are not emergencies!

Things like a car accident, unexpected home repairs, true sickness, these are emergencies! You need this emergency account so that when these things pop up – and they will- you are prepared, and you won’t have to go into more credit card debt to get out of them.

Once you have saved up $1,000 (see how easy that was😉) now you can start paying off your credit card debt. Make a promise to yourself to not put anything else on those cards and pay them off – cut them up if you have no will power. If you’re using credit cards to supplement your income, just stop. What you need to do is to rethink your spending and your income- here’s where the B word comes in – BUDGET, because all you’re doing is making your creditors rich.

If you’ve had a true emergency and must dip into your $1,000, stop working on paying off your credit cards until you build this fund back up to $1,000. Be super disciplined about it because this will give you that peaceful easy feeling that you deserve to feel about your finances. Once you’ve filled that account back up, start back at knocking off your credit card debt.

Remember that financial success is hard work and sometimes it’s not fun, however that feeling you’ll get when everything has been taken care of – you can’t beat that!

-Jodi